une maison entièrement à votre service

Gestion Discrétionnaire

Richelieu gestion

A qui s'adresse notre offre de gestion sous mandat ?

La gestion sous mandat s’adresse aux clients désireux de confier à des spécialistes de la gestion financière le suivi de leurs portefeuilles de valeurs mobilières, que ce soit en OPC, ETF, actions, obligations ou encore en produits structurés. Elle intervient dans le cadre de portefeuilles titres ou de PEA, de contrats d’assurance vie ou de capitalisation, de droit français ou luxembourgeois, ou encore dans le cadre d’une gestion pilotée.

Gérer son portefeuille nécessite du temps et une expertise.

Définir une allocation d’actifs et la faire évoluer au fil du temps est une tâche complexe qui constitue l’élément clé de la performance sur le long terme.

Déléguer la gestion de ses avoirs représente un acte de confiance fort.

Il s’agit d’un partenariat basé sur les convictions de nos équipes de gestion et la transparence dans nos actes de gestion.

Pour les investisseurs souhaitant diversifier leurs placements

Nous concevons des stratégies d’investissement adaptées à votre situation personnelle et fiscale, vos objectifs financiers, votre horizon d’investissement et votre tolérance au risque.

La politique d’investissement, pilotée par notre stratégiste Groupe, couplée à une sélection rigoureuse d’instruments financiers en architecture ouverte et titres vifs, nous permet de créer des portefeuilles dans des contrats d’Assurance vie, des contrats de capitalisation ou encore des comptes-titres et PEA.

Notre offre se distingue par une forte proportion d’investissements internationaux en actions, hors Europe (y compris dans les PEA), des choix thématiques et un suivi rigoureux du marché obligataire sur tous les sous-segments (Investment grade, High yield, souverain…), source de performance à long terme.

Nos équipes peuvent également vous accompagner dans la définition d’une politique de gestion sur-mesure dans le cadre de notre offre dédiée.

Nos offres en GSM

ACCESS RICHELIEU

ACCESS RICHELIEU

Une allocation principalement constituée

d’OPC du Groupe Richelieu, complétée

d’ETF pour une plus grande flexibilité

dans la gestion tactique de l’allocation.

Cette offre est déclinée selon différents

profils de risque, dans le cadre de notre

approche « Impulsion ESG » (1). Une

offre accessible à partir de 125 000

euros.

PREMIUM RICHELIEU

PREMIUM RICHELIEU

Un concentré de toutes nos expertises

en termes d’allocation d’actifs et de

choix de supports en architecture

ouverte (OPC, ETF, Titres en direct)

pouvant intégrer, sous réserve

d’acceptation des clients, des produits

structurés. Cette offre est déclinée selon

différents profils de risque, dans le cadre

de notre approche « Impulsion ESG »

(1). Une offre accessible à partir de 500

000 euros (100 000 euros pour les

PEA). Richelieu Gestion propose des

Mandats classiques ou des Mandats

ESG et vous propose d’ouvrir votre PEA

sur le monde en choisissant l’offre PEA

MONDE afin d’être exposé de façon

significative, via des supports éligibles, à

la croissance des entreprises du monde

entier.

RICHELIEU DÉDIÉ

RICHELIEU DÉDIÉ

Une personnalisation de la gestion qui

permet de répondre aux attentes des

clients aux objectifs ciblés. Une offre

accessible à partir de 1 million d’euros.

MANDATS Produits structurés

MANDATs Produits structurés

Construction du mandat produits structurés :

- Sélection des produits par les gérants

- Appel d'offre systématique en architecture ouverte

- Execution (passage d'ordres)

- Monitoring & Reporting trimestriel

L’équipe de gérants s’appuie sur l’expertise de Banque Richelieu France qui structure pour vous des solutions sur mesure adaptées à vos anticipations et à vos objectifs spécifiques.

Grâce à un accès direct aux salles de marchés et au principe d’architecture ouverte, nous sommes en mesure de vous proposer une gamme de produits innovants et une exécution au meilleur prix.

- Sélection des produits par les gérants

- Appel d'offre systématique en architecture ouverte

- Execution (passage d'ordres)

- Monitoring & Reporting trimestriel

L’équipe de gérants s’appuie sur l’expertise de Banque Richelieu France qui structure pour vous des solutions sur mesure adaptées à vos anticipations et à vos objectifs spécifiques.

Grâce à un accès direct aux salles de marchés et au principe d’architecture ouverte, nous sommes en mesure de vous proposer une gamme de produits innovants et une exécution au meilleur prix.

(1) L’approche « Impulsion ESG » de Richelieu Gestion se caractérise par un indicateur ESG, pourcentage du mandat en OPC ou ETF intégrant des critères ESG dans leur processus d’investissement. Cet indicateur n’est pas figé et a vocation à s’élever dans le temps.

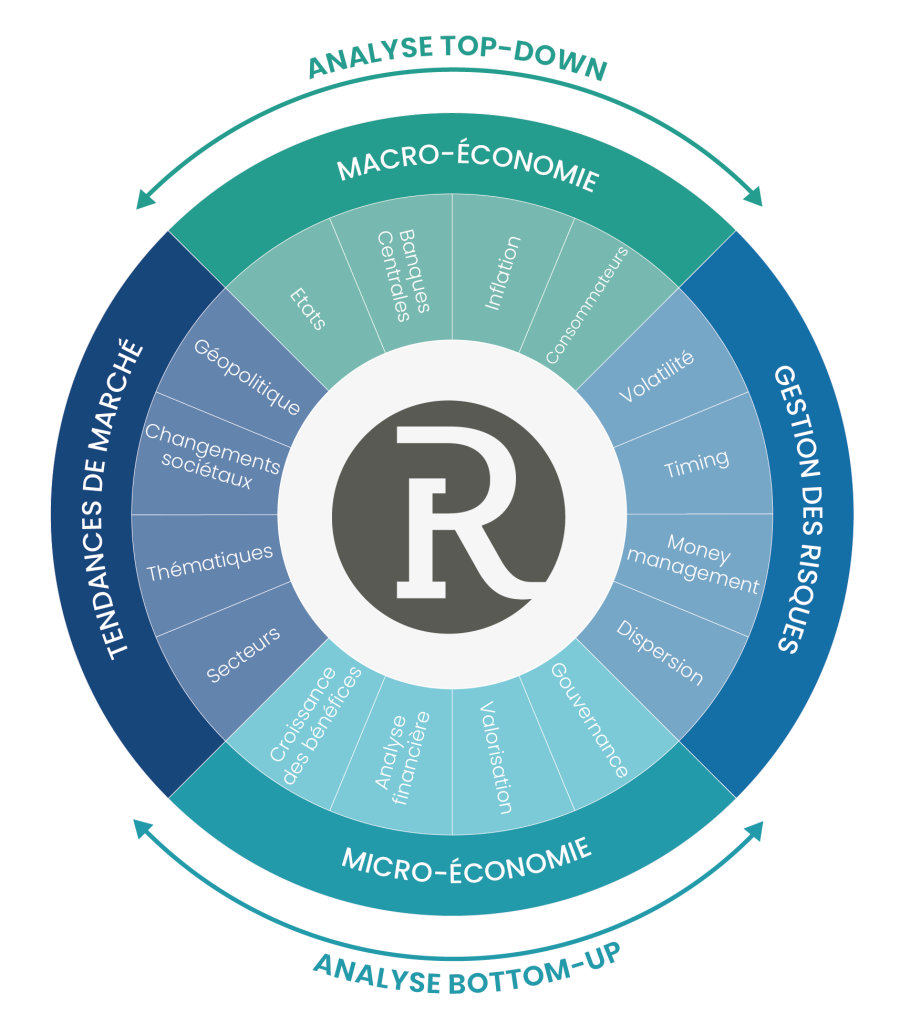

Notre processus d'investissement

Notre processus d’investissement repose sur deux approches interdépendantes : la macroéconomie et les thématiques d’investissement.

Nous cherchons en permanence à tirer profit des différentes phases du cycle économique.

SÉLECTION DES SUPPORTS

OPC

- Notation Quantalys

- Performances

- Classements

- Rencontres SGP

- Encours

- SFDR

ETF

- Indice répliqué

- Tracking Error

- Tarification

- Fourchette de cotation

TITRES VIFS

- Valorisation

- Perspectives de croissance

- Endettement

- Potentiel de hausse

- Notation ESG

Nous travaillons en architecture ouverte et sélectionnons les supports d’investissement les plus adaptés, sur la base d’une analyse quantitative et qualitative, en s’appuyant sur les recommandations de nos prestataires de recherche et notre propre expertise, en intégrant la gamme Maison.

Une équipe indépendante et dédiée au contrôle des risques travaille en étroite collaboration avec les équipes de gestion tout au long du processus d’investissement pour s’assurer du respect de la conformité du mandat aux exigences et attentes du client.

Pure player de la gestion de fortune

Banque Richelieu France

Un service patrimonial complet de conseil et de gestion sur-mesure

En savoir +

Boutique banque privée

Banque Richelieu Monaco

Une banque privée à taille humaine pour les grandes fortunes internationales

En savoir +

solutions de gestion

Banque d'affaires