The return to grace of a neglected European market ?

By Alexandre Hezez, Group Strategist

Editorial

But who will buy European equities?

It is true that the question now makes one smile, given the expectations of most analysts. In 2022, the appetite for old Europe was low. This is primarily due to the war in Ukraine, but also to the European Central Bank’s decision to fight galloping inflation at all costs.

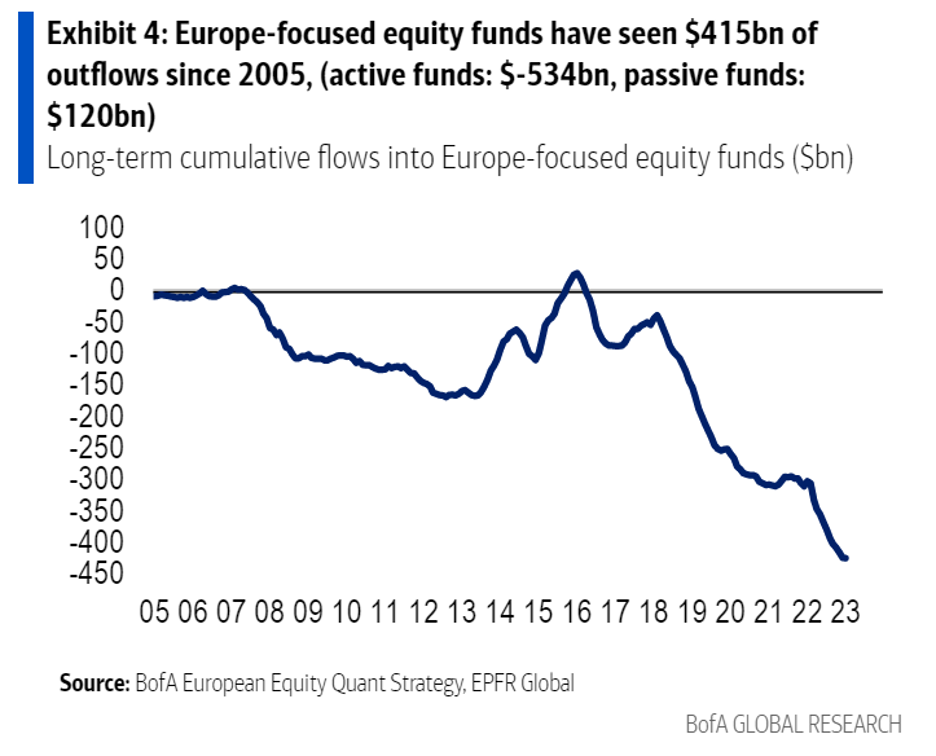

Since 2016, European funds have seen more than 400 billion in outstanding funds disappear. The referendum on the United Kingdom’s membership in the European Union has had an impact. Distrust of European assets has continued to grow.

At the beginning of December, in our 2023 outlook, we wrote that a recession in Europe was inevitable with strong heterogeneity within the zone. Two countries were the focus of attention : Germany and Italy, whose industrial fabric was particularly affected by the risks of energy shortages.

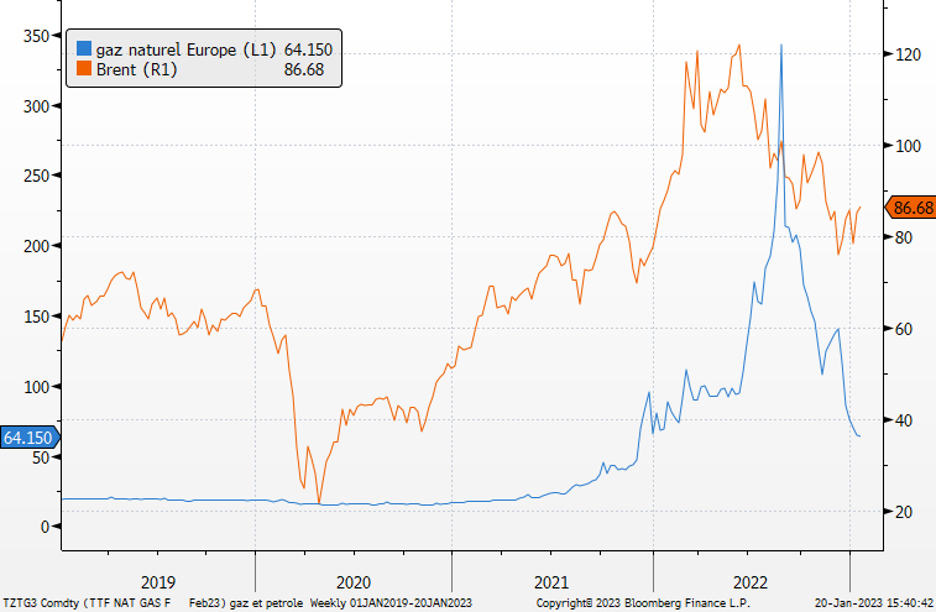

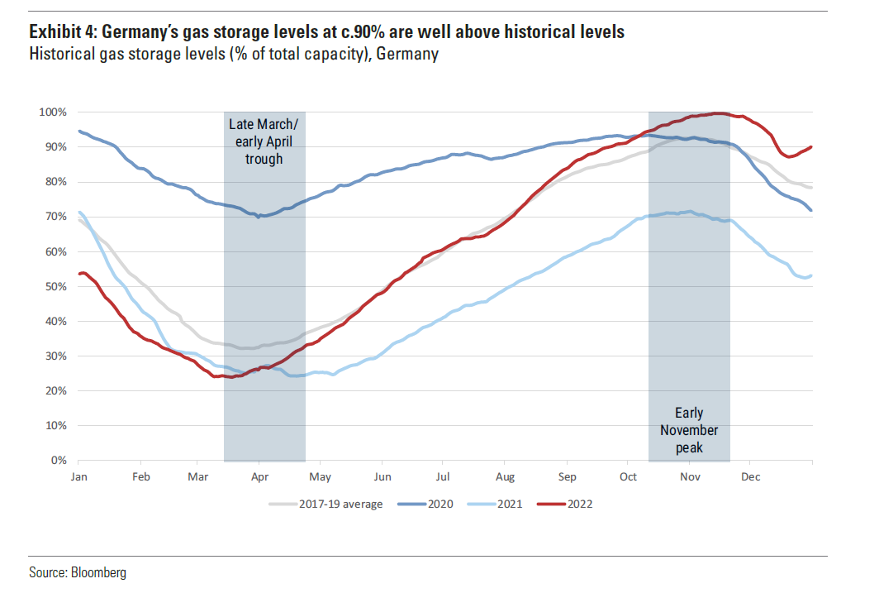

We had forecast a recession of around -0.3% for the year 2023. The particularly mild winter temperatures and the efforts made by Europe in terms of energy consumption have led to a drop in gas prices and reserves are building up to levels sufficient to avert the risk of an energy crisis. It is now the turn of our estimates for Europe to be revised upwards following the fall in gas prices.

In short, we no longer expect a recession in Europe in 2023 amid a more resilient growth dynamic at the end of 2022. The data of positive surprises continued when the German statistical office (Statistisches Bundesamt) announced that the German economy stagnated instead of contracting in the fourth quarter.

Sources: Bloomberg, Richelieu Group

At the energy level

All the measures to limit electricity consumption, mild temperatures and low LNG (Liquefied Natural Gas) imports in China mean that gas stocks remain abnormally high in Europe (90% vs. historical average of 65%). The threat of an energy crisis over the next 9 months is no longer an issue, gas prices have collapsed and the increases for individuals now seem to be behind us. The spectre of an energy shortage is receding in the Eurozone. Thanks to the sobriety measures deployed in all countries and the mild autumn and winter, the risk of an energy shortage has significantly decreased in Europe, which also eliminates the risk of a serious recession on the old continent. Indeed, gas stocks have recently stabilized at high levels, at 90%, which provides a “margin of safety” for this winter and the next. In Germany, it is estimated that there will be no supply disruption even in the event of a sharp drop in temperature. Moreover, the country should be able to replenish its stocks to get through the coming winter, even if Russia were to cut off its exports to Europe completely. These reassuring words echo those of RTE (French electricity transmission system operator), which also indicated that the situation continues to improve in France for electricity production while consumption is down by 10%. The two main economies of the euro zone, which could have run out of electricity for one and gas for the other, are therefore seeing the threat of shortages diminish, which has increased risk appetite in the financial markets at the start of the year. The economic situation has benefited from the reduction of extreme risks. The energy crisis-related stimulus has doubled since September to a level close to 4.5% of GDP for the eurozone as a whole, not counting a possible European support plan for industry in the pipeline to counteract theInflation Reduction Act in the United States (to be discussed at the next European Council in early February).

Source : Bloomberg

However, the drop in gas prices alone would not be enough to change the negative opinion on European assets. It is also an earlier reopening of China that changes the game.

At the level of macro-economic indicators

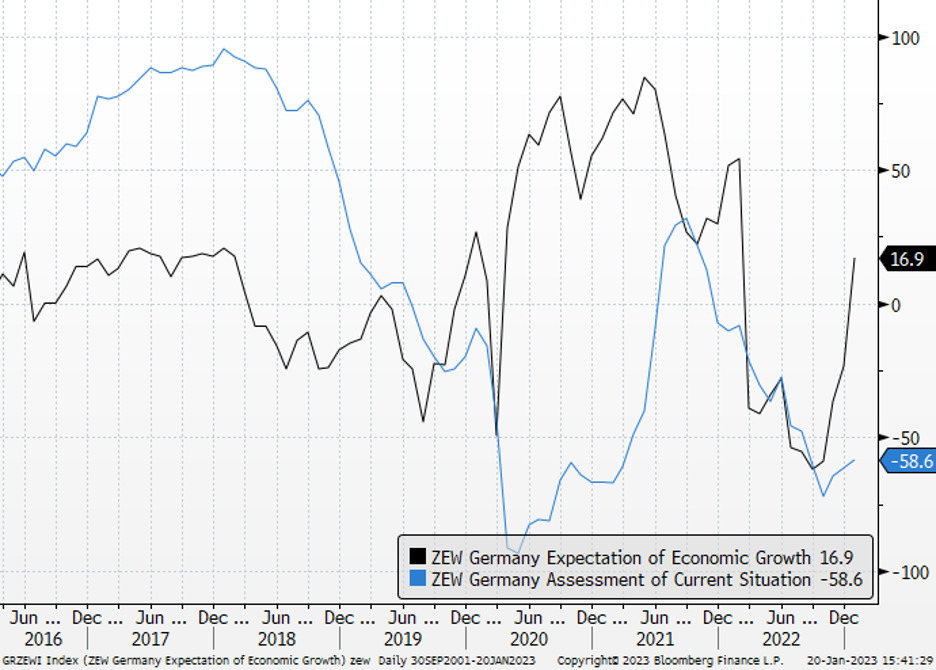

The ZEW index of German investor sentiment is positive again for the first time in over a year as fears of a severe recession decreases. The deterioration in private sector activity in the euro zone eased significantly in December. Thus, despite six consecutive months below the 50-point threshold that separates expansion from contraction in activity, the December composite PMI reading was the best in five months. The business outlook has improved significantly in recent weeks. First, incoming data has remained surprisingly resilient – especially hard industrial data – and the latest survey data has increased significantly.

Sources: Bloomberg, Richelieu Group

In terms of growth

We are therefore revising up our growth forecast for the Eurozone from -0.3% to +0.3% for 2023, which is well above the consensus expectation of -0.1%. If we consider the member states, the differential remains the same. We expect weaker growth in Germany and Italy (which are more dependent on energy-intensive industrial activity) than in France and Spain (which have more diversified energy sources and are relatively more focused on the service sector). This reflects sluggish growth dynamics, high inflation (which is weighing on real household incomes and consumer spending) and tighter financial conditions.

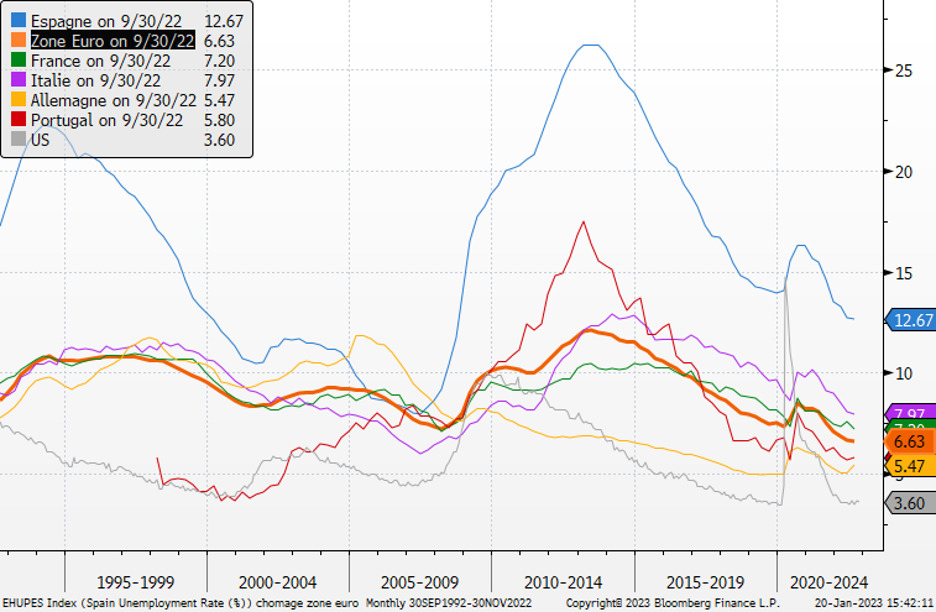

In terms of employment

The labor market remains, as in the United States, resilient. We expect only a slight increase in the unemployment rate in the Eurozone during the winter months. Germany, Belgium, France and many other European countries have had to raise their minimum wages in the face of returning inflation to avoid a social crisis in 2022. According to the European Central Bank, wage growth in the Eurozone is expected to be “very strong” in the coming year, exceeding historical benchmarks and partly catching up with the uncurbed inflation since 2021. It fears an “inflationary spiral”. Given the strength of leading indicators, we expect wage growth to accelerate significantly to nearly 5% in the first quarter. The eurozone labor market is tight – with an unemployment rate close to its structural rate – but not as overheated as the U.S. labor market.

Sources: Bloomberg, Richelieu Group

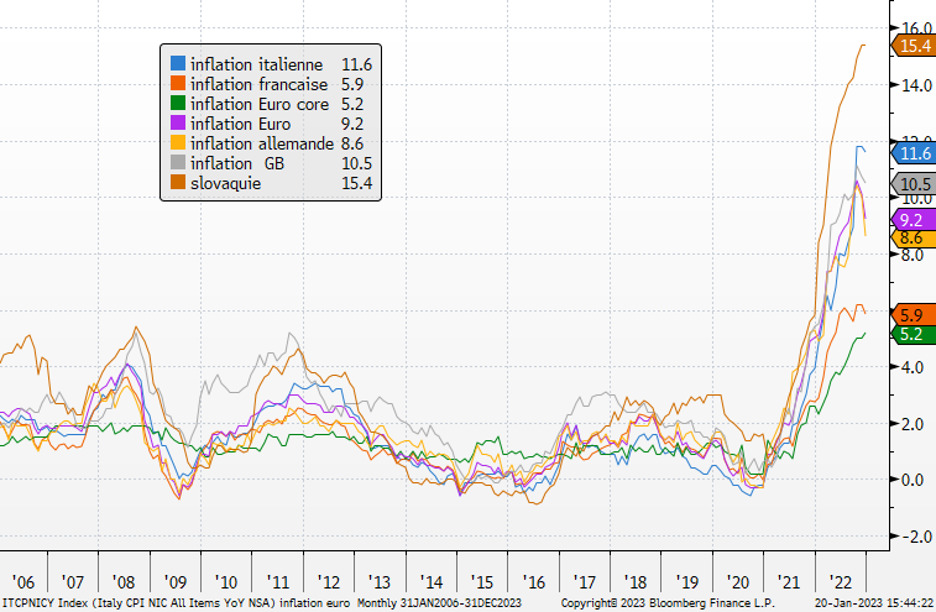

In terms of inflation

Inflation has risen above the peak as a result of the sharp drop in wholesale energy prices. Headline inflation will remain very high in January and February. We also expect core inflation to ease as goods prices slow, but we see continued upward pressure on services inflation due to rising labor costs. We therefore expect core inflation to ease gradually to 3.3% by the end of 2023, still far from the monetary authorities’ target levels.

Source : Bloomberg, Richelieu Group

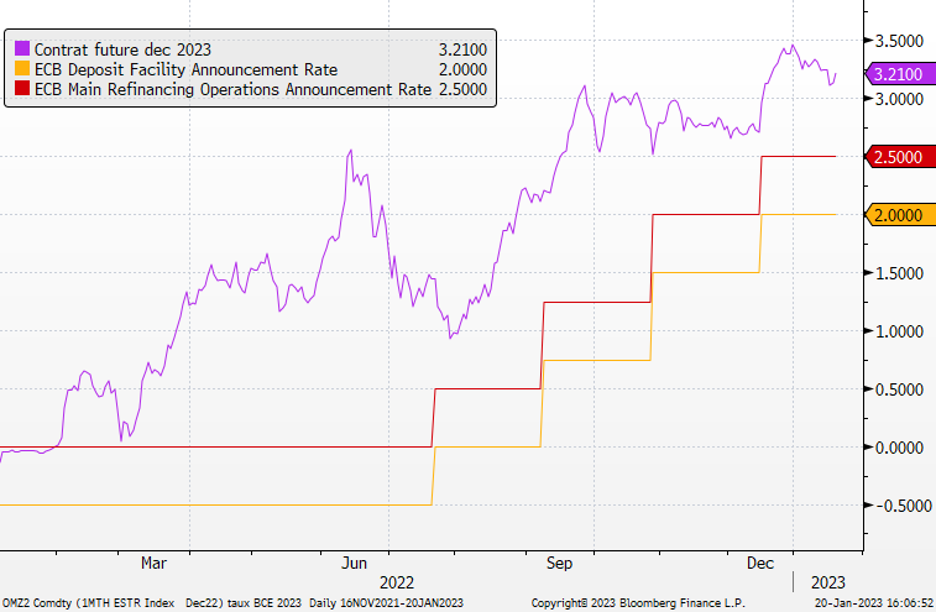

At the ECB level

“ Inflation, no matter how you look at it, is way too high in the Eurozone ” – Christine Lagarde

In Davos, the president of the European Central Bank said she wanted to stay the course in the fight against rising prices. If there is a ” soft landing ” scenario, given the increased resilience of activity, sustained underlying inflation and hawkish comments, we believe that the ECB will take the opportunity to tighten rates significantly in the coming months.

We think 50 basis point increases are very likely in February and March, before slowing to 25 basis points for a final rate of 3.25% in May. The ECB will stay the course until we have moved into restrictive territory long enough to get inflation back to 2% within a reasonable time frame. We don’t see a first reduction until at least mid-2024. The ECB will start applying Quantitative Tightening at the end of the first quarter, reducing APP (Asset Purchase Program) holdings by 15 billion euros per month from March to June (nearly 180 billion euros for 2023).

Sources: Bloomberg, Richelieu Group

At the political level

We see several potential events that could exacerbate tensions. First, France ‘s difficult fiscal outlook and pension reform. Second,Italy, which is on a narrow fiscal path given its very high public debt, rising sovereign yields and slowing growth. Giorgia Meloni’s government has pursued an orthodox, pro-European policy since its election victory. The Board of Governors is likely to use its PEPP reinvestment flexibility to guard against a rapid widening of spreads. The Greek and Spanish elections could call European solidarity into question, given the social discontent linked to inflation. The focus for the next few weeks remains the potential political instability in Germany due to the tensions with Ukraine.

In terms of investments

Constrained by a deteriorating geopolitical environment since the war is at its borders, the European Union must strengthen its independence. But the Washington decisions served as a wake-up call, given the magnitude of theInflation Reduction Act ($369 billion) and will have to push Europe to address the competitiveness of its industry. Indeed, in the face of the Chinese model and the growing support of the United States, the delay in the industry of tomorrow, whether related to the energy transition, innovation or defense, is significant. A major joint recovery plan could thus be quickly announced, targeting energy and climate, industry and defense as a priority. No amount has been mentioned but the envelope will necessarily be important in order to compete with the means deployed for the other powers. It was already following the initiative of the Franco-German couple that Europe had unveiled a historic recovery plan in the face of Covid. The January meeting between Emmanuel Macron and Olaf Scholz was also intended to consolidate European perspectives. Part of the financing will most likely come from the unused funds of the previous stimulus package, but an additional amount could also be issued on the financial markets, which will require validation by other European countries, especially the so-called “frugal” ones, such as the Netherlands or Finland, which are reluctant for the moment.

However, the shift initiated by the Franco-German couple could have enough weight, as in 2020, to obtain global adhesion.

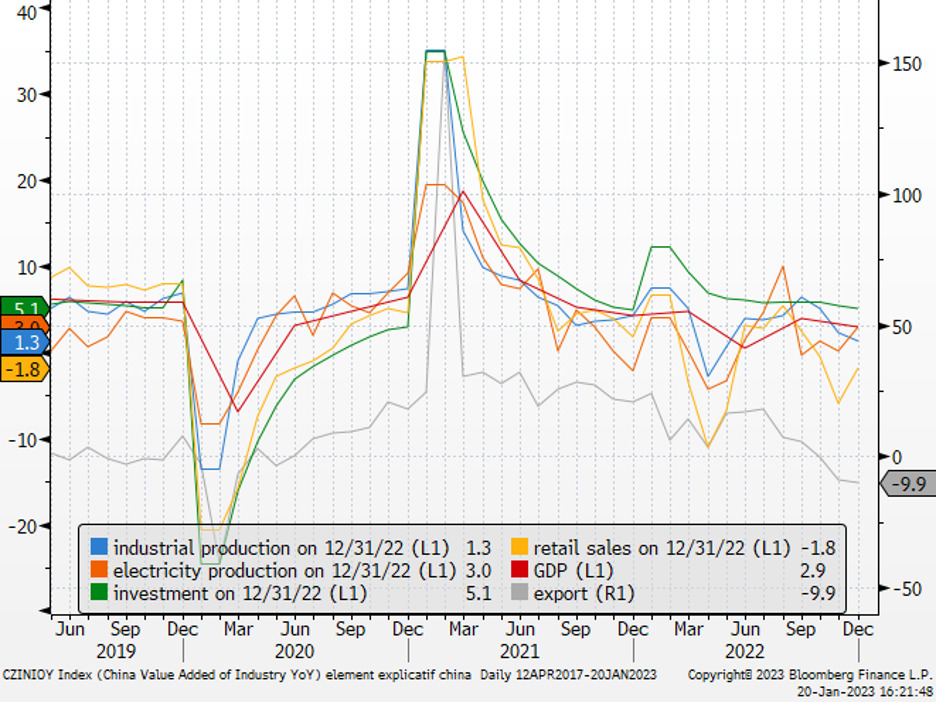

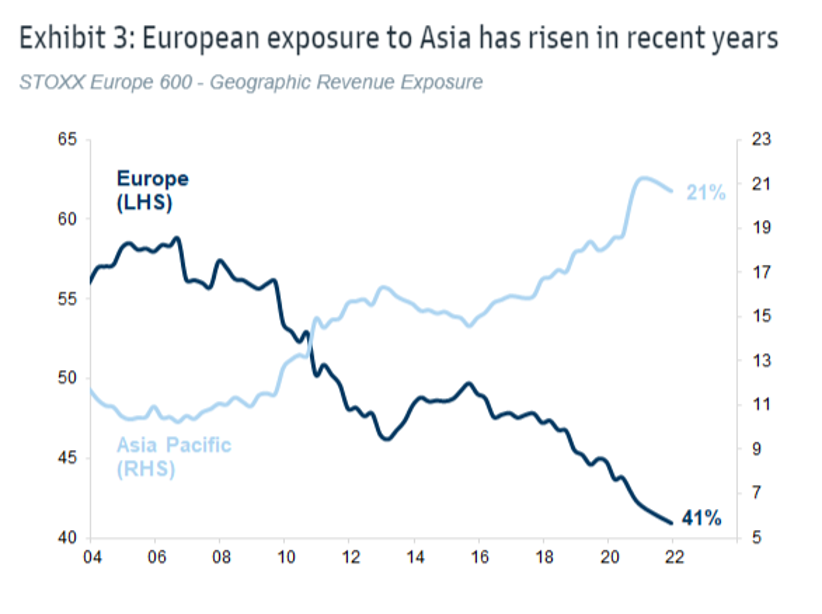

At the level of China

The reopening of China provides an additional boost to Europe, both in terms of economies and the equity market, where about 10% of sales are to China. Growth forecasts will be raised. Europe’s exposure to Asia has increased significantly in recent years. Europe’s return to favor among investors depends largely on the success of the Chinese reopening. Life has since returned to normal in most countries. And after three years of confinements, mandatory quarantines and screenings, China lifted almost all of its health restrictions in December. The arrival in rural areas of tens of millions of Chinese from the cities, on the occasion of the Chinese New Year festivities, could cause an increase in cases. However our central scenario remains that of a successful implementation of the new “Covid control” policy. The economic and sanitary health of China is obviously not without consequences for other geographical areas and mainly for Europe due to the impact of a decrease in constraints in the supply chain and trade between the two areas. Chinese growth is expected to rebound in 2023 to 5% (from 4.8% previously). On the import side, the decline is notable (-7.5% in December) but the outlook is much more favorable. They have suffered because of the surge in contamination since the abandonment of the “zero-Covid” strategy. The situation is starting to improve and travel is picking up, which will help to drive a significant rebound in demand. This will be all the more powerful as households have accumulated savings throughout 2022 and will be able to use some of them in 2023 to boost the recovery in consumption. The lifting of the “zero-covid” policy and support for the economy, especially the real estate market, will revive Chinese credit and consumption. This will have positive consequences in terms of demand for European products.

Sources : Bloomberg, Richelieu Group

At the company level

After a resilient 2022 at the corporate level, we will have, with a lag effect, downward revisions to earnings. In 2022, European EPS (Earnings Per Share) were up 18% (+6% ex-commodities) for 2.9% global growth. With 2.2% global growth expected for 2023, top-down expectations of -5% for EPS (-4% excluding commodities) imply pressure on margins (-100bp to 7.5%). As a reminder, 1 point of additional global GDP implies 10% upward revisions of European EPS. So if the consensus were to revise 2023 global growth to fit our numbers, that would imply (all else being equal) upward revisions to 2023 EPS.

Sources: Twitter, Goldman Sachs

At the level of valuations

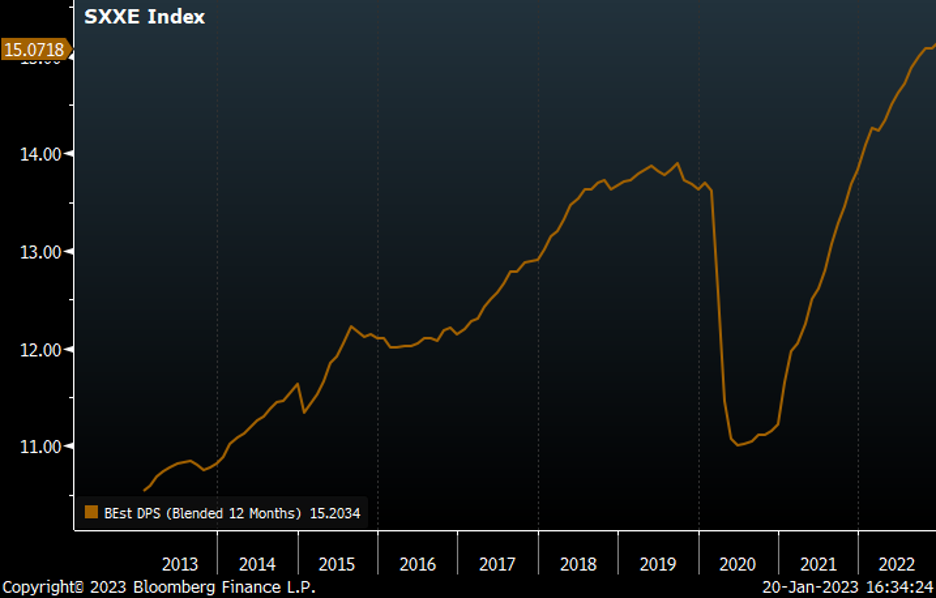

Europe remains relatively attractive compared to other regions. The 12-month Price Earning for Europe, at around 12x, is below the 20-year average. In addition, the discount to the US remains significant in most sectors. This discount may be justified, given the war in Ukraine and Europe’s energy problems, but Europe also has a sector mix that may be more favorable in the event of inflation and higher interest rates. We still see returns as being hampered by soft growth and higher rates, but additional news flow has been positive. The appeal of dividend yield investments in more uncertain times remains an advantage in the months ahead. In Europe, there is room to increase dividends, as payout ratios are historically low. Dividends typically account for two-thirds of total returns over the cycle. With returns on capital likely to be lower, we believe that income should be favored.

Sources: Bloomberg, Richelieu Group

Europe was not forgotten, it was carefully put aside by investors, for objective reasons, notably geopolitical. The widespread mistrust could be transformed, perhaps too quickly, into a zone of trust as a whole. Obviously the stakes remain high, but the investment case and market sentiment could begin to reverse in a more profound way, given the parameters we have outlined, and finally attract international investors.

CONVICTIONS

POSITIONING WITH RESPECT TO RISK CRITERIA

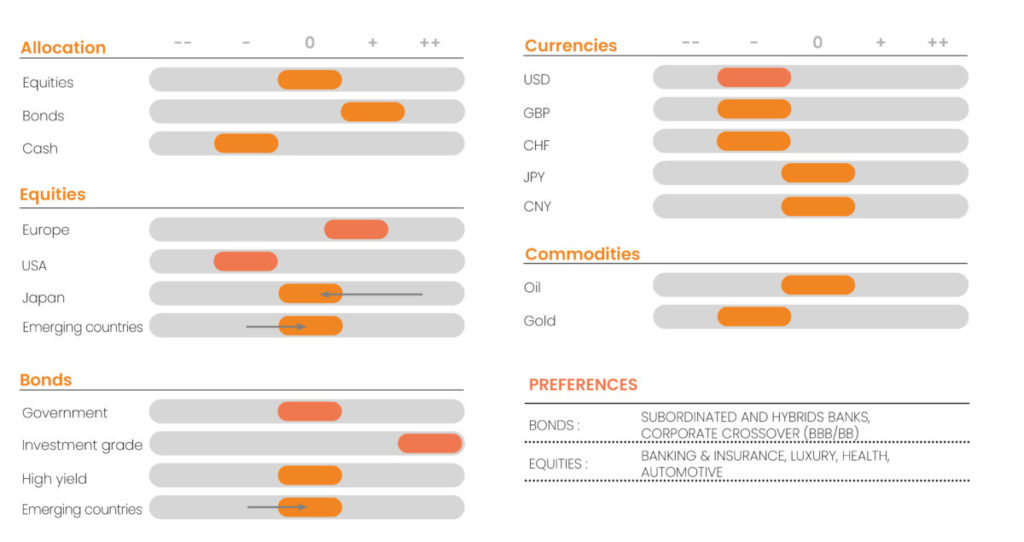

Our central scenario remains soft growth without recession in the major geographic areas (we have revised upwards our forecast for European growth given the faster than expected reopening of China and the fall in gas prices). We do not doubt a disinflation scenario, but the return to the central banks’ objectives is still a long way off and the very aggressive speeches of the FED and the ECB will amplify volatility. Indeed, the desire not to improve too intensely the conditions of credit distribution that could prove inflationary will be constant throughout 2023. The rate hikes will end in May but we don’t expect any rate cuts until at least mid-2024. We should have better visibility which should gradually impact risk premiums as a whole.

As far as the equity markets are concerned, the euphoria of the beginning of the year could well come to a halt given the corporate results which could raise some doubts. We believe that there is little threat to equity market valuation levels if the smooth slowdown scenario is confirmed and inflation does indeed moderate. Our central scenario remains of this kind. The reopening of China provides an additional boost to Europe, both in terms of economies (especially Germany) and the equity market, where about 10% of sales are to China. There are several ways to gain exposure to the theme of China’s reopening: industrials, luxury goods and raw materials sectors. Germany and Japan could also benefit. As far as Japan is concerned, it is likely that the Bank of Japan’s monetary policy will change with the new president. We decrease our positioning of the country to neutral. We continue to believe that Japan is a good proxy for China’s reopening, but a rebalancing between the two countries seems timely due to an accelerated reopening and a desire by the government to revive consumption. The Central Economic Work Conference in December only confirmed the focus on expanding domestic consumption in 2023. The sudden and unexpected end of the Covid zero policy is expected to cause a sharp acceleration in growth towards the end of 2023. Combined with the weakening of the US dollar and the attractive valuations of Chinese market assets, this should contribute to the attractiveness of equities over the medium term. Therefore, we are positive on China. As for emerging markets, we continue to think that we need to wait for the Fed’s pivot and that it may still be a bit early to reinvest heavily, although the prospect of a weaker dollar improves visibility. Overall, we have a more constructive view on emerging markets in the wake of China, which should stimulate economic growth throughout the emerging world.

We maintain a negative view, more cautious in the short term, on the U.S. markets given the deterioration of leading indicators and the pressure on the dollar. In terms of sectors, we have a preference for innovation stocks, which have already been significantly corrected. Reshoring should continue to benefit small and medium-sized US companies.

After a difficult year in terms of spreads and rates,credit offers very interesting entry points, mainly in investment grade. We still believe that the quality segments of High Yield are also to be favored. Carrying allows for more volatility due to the fear of a recession. In high yield, we therefore prefer the highest-rated issuers (BB+BB-) and reinvest in financial subordinates and hybrids. The risk of extension (non-repayment of the call) seems to be integrated and the issuers, senior IG debt, seem to maintain their refinancing commitments on these instruments. The announced recession is a risk but we believe that the contained rise in default rates is already well anticipated in the spreads. The current levels are a satisfactory entry point and allow us to focus on the best risk/reward ratio. The past few years have warranted a certain amount of caution with regard to emerging assets, but we are now seeing more and more interesting opportunities. The emerging debt asset class has incorporated expectations of rate hikes. As we wrote last month, we should be selective and focus on countries that maintain a healthy balance of payments, manageable financing needs and, above all, credible monetary policies.

EURUSD should continue to appreciate. Our target of 1.10 is almost reached but the recent speeches of the US central bankers suggest that the normalization of the FED is crumbling. The discrepancy in monetary policy discourse between the Fed and the ECB is in favor of the euro. In addition, economic indicators point to positive surprises from the Eurozone. USD momentum and flows remain bearish against all other currencies. We therefore maintain our negative view on the dollar even though we believe the currency should remain in a 1.07-1.12 range. The main element for a reversal would be a strong geopolitical deterioration that would allow the dollar to regain its safe haven status.

Sources : Bloomberg & Richelieu Gestion

Synthesis Strategy Richelieu Group – Author

Disclaimer

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

The information, opinions and estimates contained in this document are for information purposes only. No element can be considered as an investment advice or a recommendation, a canvassing, a solicitation, an invitation or an offer to sell or to subscribe to the securities or financial instruments mentioned. The information provided concerning the performance of a security or financial instrument always refers to the past. Past performance of securities or financial instruments is not a reliable indicator of future performance.

All potential investors should conduct their own analysis of the legal, tax, accounting and regulatory aspects of each transaction, if necessary with the advice of their usual advisors, in order to be able to determine the benefits and risks of the transaction and its appropriateness to their particular financial situation. He does not rely on Richelieu Gestion for this.

Finally, the content of the research or analysis documents or their excerpts, if any, attached or quoted, may have been altered, modified or summarized. This document has not been prepared in accordance with the regulatory provisions designed to promote the independence of financial analysis. Richelieu Gestion is not prohibited from trading in the securities or financial instruments mentioned in this document prior to its publication.

Market data is from Bloomberg sources.