2023, a long and laborious disinflation but a disinflation !

By Alexandre Hezez, Group Strategist

Editorial

We have recently had some reassuring signs counteracting the successive bad news accumulated throughout 2022.

U.S. inflation finally surprised on the downside, European weather was benign and gas prices fell sharply, Russia withdrew militarily from Kherson, and the U.S. elections had a mixed result, reducing the risks of an inflationary fiscal expansion. News of China’s reopening has improved, despite the fact that the health situation remains highly unpredictable. U.S.-China relations stabilized with a meeting between Presidents Biden and Xi at the G20.

Source: Bloomberg

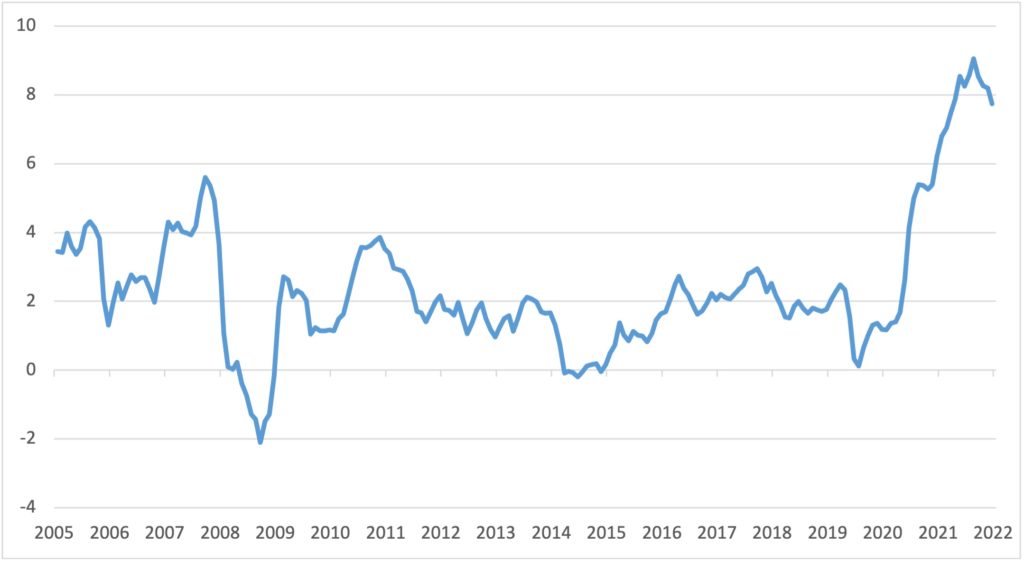

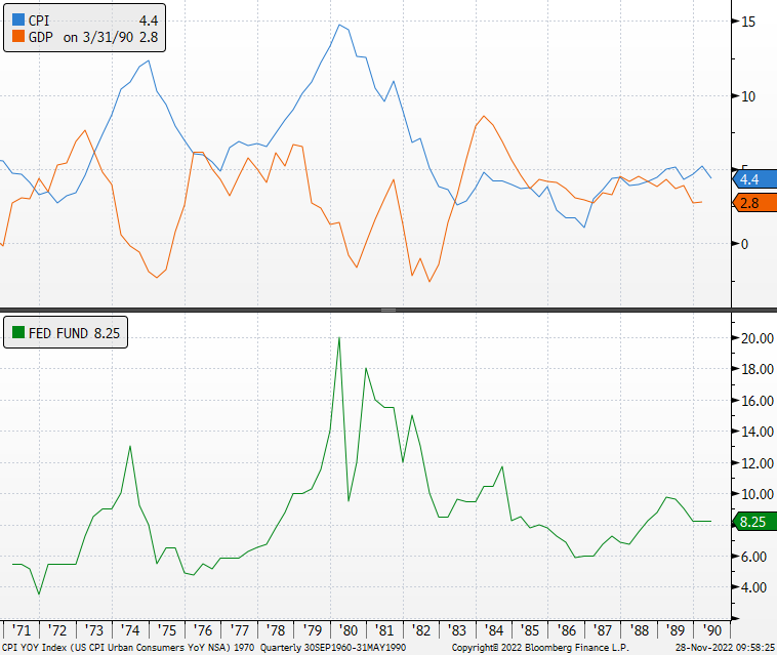

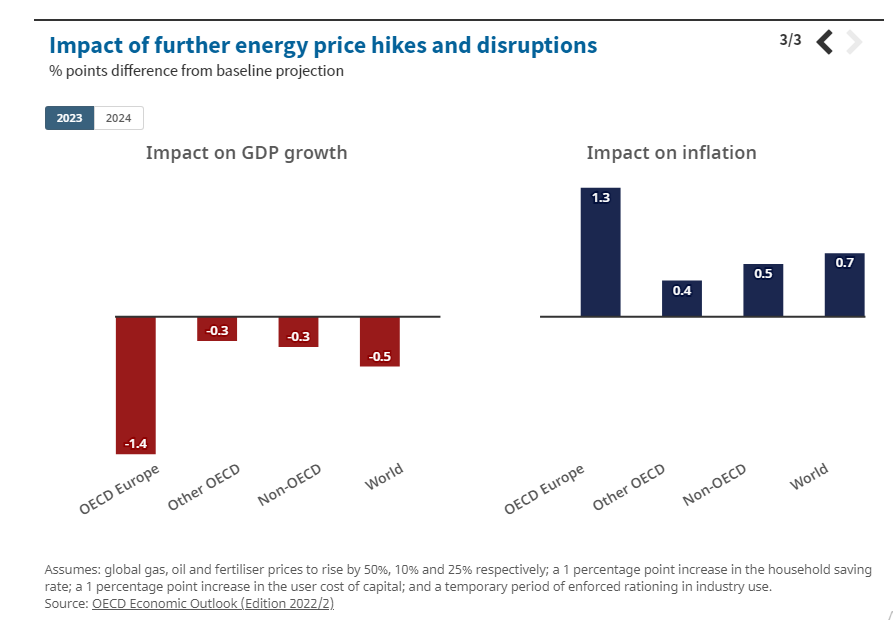

The world economy is facing the worst energy crisis since the 1970s. The energy shock has pushed inflation to levels not seen in decades and is weighing on growth worldwide.

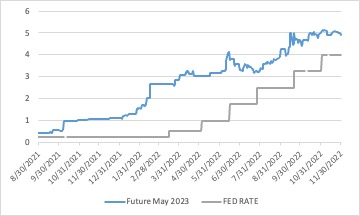

After falling behind in 2021 in the face of rising prices, central banks in Western economies quickly turned into inflation fighters. This year, the macroeconomic consensus has shifted from the ability of central banks to avoid a total slowdown as they have done for the past 10 years to the view that central banks will engineer a soft economic landing in 2023.

For Jerome Powell, the mistake of the 1970s was to have lowered rates too early following the recession that followed. The Fed chairman prefers a stronger recession because inflation control is the guarantee of sustainable growth.

From the second quarter of 2023 onward, we believe that decelerating inflation, a pause in central bank rate hikes, China’s re-acceleration, and easing supply chain disruptions should all support risk appetite.

Forecasting is not an easy task, but we believe that this year is particularly challenging. Not only because there are many uncertainties that exacerbate the conflicting views based on the information we have, but also, and this is certainly the most crucial point, because this is still a historical period and any behavior appears unusual from an econometric point of view.

Source: Bloomberg

Global growth has slowed in 2022 due to diminishing reopening momentum, fiscal and monetary tightening, Covid restrictions and the real estate collapse in China, and the Russia-Ukraine war.

We forecast global growth of only 2.4% in 2023 (after 3.1% in 2022), with the resilience of the US and its consumer contrasting with a sharp European recession earlier this year and a chaotic reopening in China. Asia will be the main driver of growth in 2023 and 2024, while Europe, North America and South America will have very low growth rates.

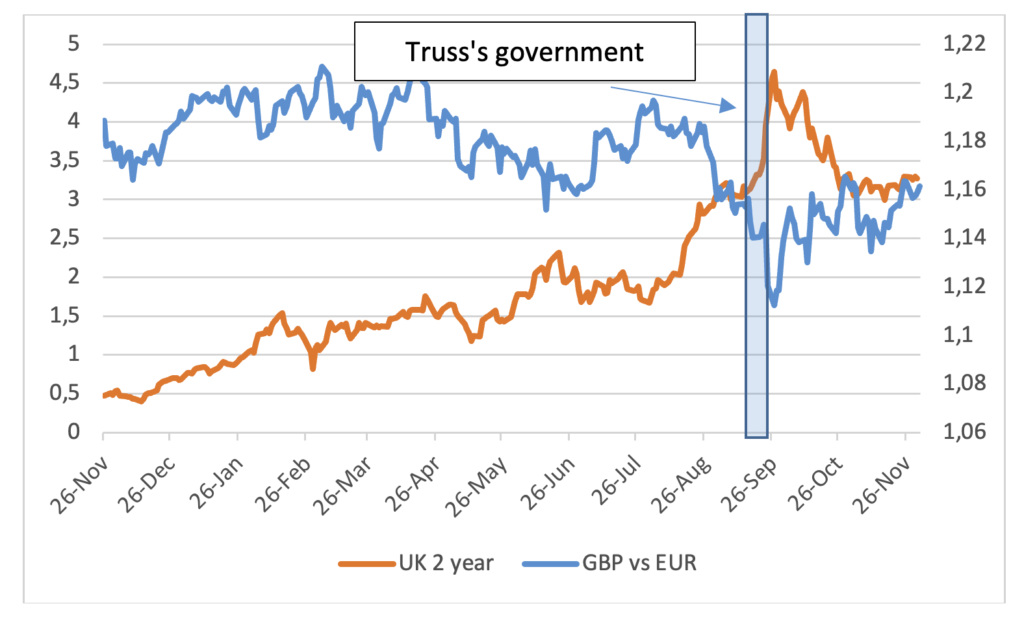

Further monetary tightening is needed to fight inflation, while fiscal support measures will need to be more targeted and temporary. The Liz Truss episode in the United Kingdom, with the systemic fear of the implosion of pension funds, was a saving grace for any attempt at inflationary stimulus by a state.

Source: Bloomberg

The United States

The US should narrowly avoid a recession for the year: we expect a soft landing scenario or, at worst, a technical recession. The Fed’s efforts to “cool” the economy by violently tightening financial conditions are beginning to bear fruit.

U.S. inflation is expected to slow steadily throughout the year but remain at levels well above historical levels. The disinflationary impact of the recent normalization of supply chains and rental housing markets will take time, but is underway. As we like to repeat, Jerome Powell, marked by the stagflation episode of the 70’s, will have no inclination to cut rates in 2023. We believe that the central rate will be reached in April at 4.75%/5% and will remain at this level at least until the end of 2023 or even until the first quarter of 2024 (we will certainly have time to talk about 2024!). Real estate activity will continue to deteriorate. The labor market should remain buoyant and maintain a level of consumption that is certainly declining but sufficient to avoid a brutal recession.

Source: Bloomberg, Richelieu Group

The headwinds of a weakening labor market, rising borrowing costs, tighter credit standards, and weakening balance sheets will cause consumers to temporarily reduce spending and push the savings rate higher. U.S. businesses’ access to market financing (stocks and bonds) has also been sharply reduced, which should help slow their final demand. Paradoxically, the slowdown in consumer demand will allow companies to replenish their inventories (such as the automotive sector). Exports should contribute to growth as domestic demand weakens. These factors are behind our forecast of a benign slowdown by historical standards. Unemployment will rise to a level close to 4.5% (from the current 3.70%) leading to less pressure on wages in the second half of the year. The FED must maintain positive real rates at all costs and keep growth below its potential. In short, it will keep the pressure on all economic agents to avoid any runaway and relaxed financial conditions that would lead to a re-inflationary phenomenon. We expect core inflation to moderate rapidly over the course of 2023 as supply chain disruptions abate, inventories are replenished and labor market conditions weaken. The rising unemployment rate should put downward pressure on services inflation. Overall, we expect headline inflation to be at 3.2% by year-end. The dollar should weaken in the second half of the year as investors take into account that the FED’s target is being met (End of 2023 target at 1.08).

Europe

Recession seems inevitable in the Eurozone and the UK. Energy rationing in Europe and the necessary savings may be less than expected, but the energy supply outlook remains fragile and will not allow activity to rebound without jeopardizing the winter of 2023/24. The spot price of electricity has declined, but concerns about power supply, both 3 months and 1 year ahead, are still far from being resolved. The impact on real incomes of higher energy bills will impact household consumption. Over the year, the recession will be limited, with strong heterogeneity within the zone. Eurozone households have increased their wealth significantly since the Covid crisis. Their savings have risen sharply, with a savings surplus of around EUR 1 trillion by mid-2022. In addition, the value of their real estate assets has increased by €6 trillion over the same period. By the end of 2021, their net wealth in real terms was 9.4 times the real value of their consumption, more than the average value over the last decade. Inflation has eroded this financial cushion by cutting in half the surplus of real net wealth accumulated since Covid. By the second quarter of 2022, net wealth in real terms was only 8.7 times the real value of consumption, returning to the long-term average.

Inflation rose again in October to 10.6% year-on-year in the euro zone, driven by a sharp acceleration in food prices (13.1%) and a strengthening of energy inflation (41.5%). These two components accounted for 68% of price growth in the euro zone. Core inflation also increased, driven by an accelerated rise in non-energy industrial goods prices (6.1%), while inflation in services remained stable (4.3%). The presence of second-round effects, with a diffusion of the rise in energy prices to the other components via production costs, is visible. The weakening of the currency, particularly affecting import prices and energy prices in particular, increases the impact of the “abnormal” inflation caused by the fossil fuel shock. But we expect only a slight slowdown as Europe has already managed to reduce Russian gas imports without crushing activity and should benefit from the same post-pandemic improvements.

The ECB is lagging behind on its normalization. The European Central Bank will continue to raise interest rates until inflation returns to the medium-term target. Given the reduced risks of a deep slowdown and persistent inflation, we now expect hikes through May, with the ECB peaking at 2.75%/3% for the deposit. Eurozone growth is expected to be negative in 2023, led by the German economy among others. Weakened by Russia’s invasion of Ukraine, GDP growth has already slowed to 0.1% (seasonally adjusted quarterly rate) in the second quarter of 2022 and 0.3% in the third quarter.

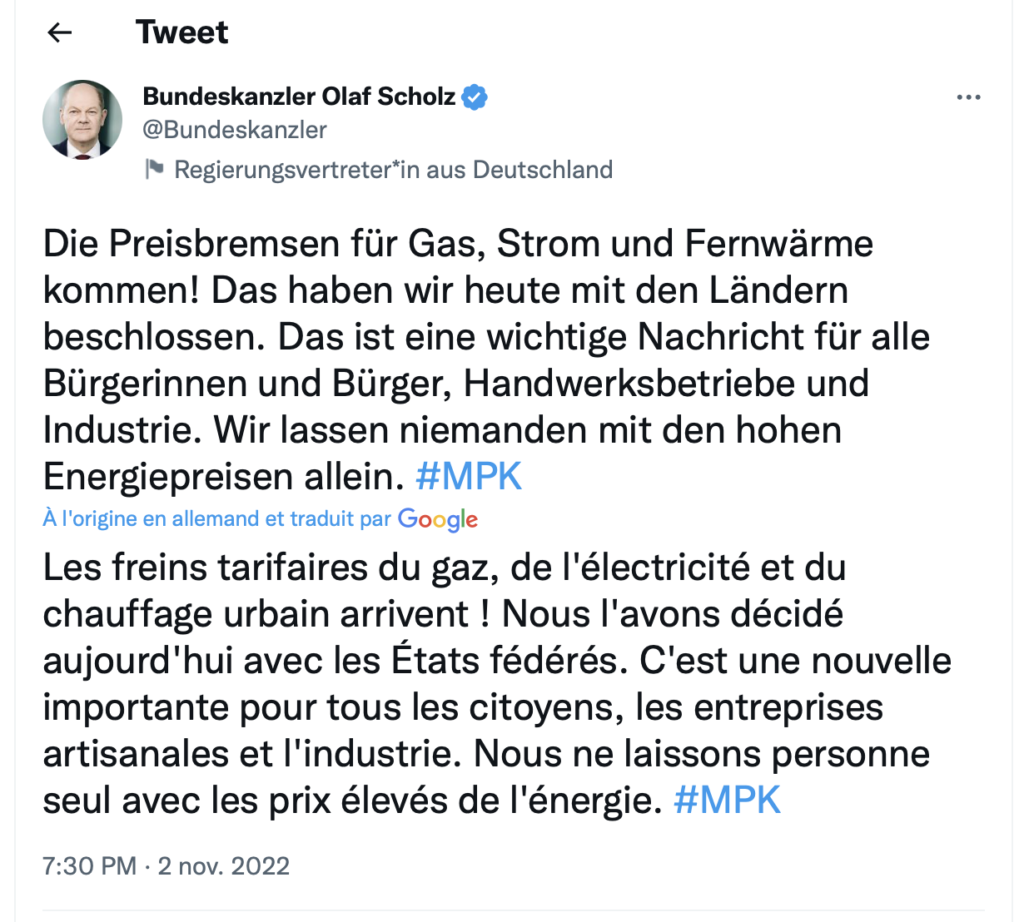

For 2023, we expect a recession of around -0.3% for the year. Investment will remain sluggish due to high uncertainty and rising interest rates, but will recover due to the scale of savings accumulated by companies and the investment needs associated with the relocation of supply chains and the development of renewable energy in the second half of the year. State governments will maintain the principle of the gas and electricity price shield, but will mitigate its effects in order to limit the burden on public finances, but budget deficits will increase, putting pressure on sovereign debt.

China

China is expected to grow slowly in the first half of the year, with the reopening in April initially triggering an increase in Covid cases that keeps caution high, but it should accelerate sharply in the second half of the year thanks to the reopening. Our longer-term view of China remains cautious due to the long slide in the property market and slowing potential growth (reflecting weak demographics and productivity). In November, the return of confidence in the Chinese economy, linked to the adjustments decided by Beijing concerning the health strategy, came in contrast to the words of Xi Jinping at the 20th Congress of the Chinese Communist Party, who remained intransigent with his “Zero-covid” policy. However, this policy seems to be reaching its limits. The population of several large cities is demonstrating and is increasingly exasperated by the confinements and restrictions. The implementation of a new sanitary policy appears to be more than necessary from a social, economic and political point of view. he reality of the epidemic situation is becoming increasingly difficult to manage. Cities with more than 10 cases of Covid, whether symptomatic or not, account for nearly 50% of China’s GDP. Local Chinese authorities have instituted strong new health restrictions (school and business closures in some Beijing districts, lockdown in Guangzhou, testing campaign) following the country’s epidemic rebound at the time of writing. The possible “test” city close to Beijing which would have recently tried to abandon the “zero-Covid” had to backtrack in a brutal way last weekend (5 days’ confinement decided).

The continuation of the zero-covid policy, in the absence of an effective vaccine strategy, will continue to penalize Chinese consumption and economic activity this winter. We do not expect a lifting of the Zero Covid measures until the second quarter of 2023, but the reopening will happen. The zero-covid policy is acting as too big a drag on activity and we should see an acceleration in Chinese consumption in the second half of the year.

The unknown remains the slump in the real estate sector. According to the IMF, 45% of developers would not be able to cover their debt service from their earnings and 20% would be insolvent if the value of their properties under construction were adjusted to current property prices. China’s central bank should offer low-cost loans to support property developers’ obligations. The country’s largest banks pledged last week to provide at least $162 billion in credit to developers. The aggressive support from Chinese authorities marks a reversal of a 2020 crackdown on speculators and indebted developers as part of a broad campaign to reduce financial risk. The November G20 helped ease international tensions with the meeting between Xi Jinping and Joe Biden, which was the first official meeting between the countries since Nancy Pelosi visited Taiwan in August.

China’s economic and sanitary health is obviously not without consequences for other geographic zones, thanks to the disinflationary impact of a reduction in supply chain constraints. China’s growth should therefore rebound in 2023 to 4.8% from 3% in 2022, and mathematically be the main driver of global growth in 2023.

Our central scenario for the three largest economies obviously remains dependent on factors that are not only exogenous (notably geopolitical or health-related) but also on inflation, which raises questions.

The higher inflation remains over time, the greater the risk that it will become entrenched. It is therefore not only essential to curb it, but above all to do everything possible to convince the players that it will remain low in the long term. For now, the gamble is won but the balance remains precarious and Jerome Powell will keep the pressure firmly on and continue to “persevere until the job is done.”

We believe that central banks in general and the Fed in particular are right to do this to preserve their credibility, by trying to bring down current inflation early enough to keep public faith in low future inflation and sustainable growth. In the very short run, the risk is that we will not do enough. As soon as we have clear evidence that prices are falling, the Fed will have been right. If not, central banks will have to go even further and the economy and assets as a whole will adjust further.

CONVICTIONS

POSITIONING WITH RESPECT TO RISK CRITERIA

Bonds are back in favor!

After a year of resilient earnings in 2022, 2023 will be more complicated. We should see a deterioration in margins, impacted by rising material costs, labor costs, interest rates and also taxation – all of which are more difficult to pass on to the end customer during a recession.

The main driver of the markets will not be earnings but valuations. And valuations will be impacted by the attitude of the central banks and more particularly the Fed. The US disinflation should take place but the Fed will remain on guard to avoid any strong easing of financing conditions and thus any rapid rise in the market.

The risks are still present, even if the good news that has accumulated since mid-October has allowed the market to rebound strongly… Perhaps a little too much so. We had insisted that the market balance was conducive to market rallies at the end of the year, justified by reassuring inflation publications. Note that hedging positions, cash at historic levels in funds and index volatilities remain very high and the slightest good news could lead to these self-feeding violent reversals. This is exactly the scenario we experienced. We maintained our neutral position on equities with a more positive view in the very short term. Our opinion is more nuanced at the end of the year. The cold snap in Europe, the demonstrations in China against Xi Jinping’s zero-covid policy and the upcoming interventions by J. Powell to calm the renewed enthusiasm should stop the rise in the short term. The December 14 meeting will be a good preview of the FED chairman’s intentions. The Fed has not said its last word and is still trying to make itself heard. As with every episode of rapid easing of financial conditions, Fed members are busy reminding us that the fight against the inflationary spiral is far from over and that key rates still need to be raised and that they will not come down quickly.

Equity markets are very sensitive to new information that changes perceptions on the margin. In recent weeks, there have been factors that have been more positive than investors feared a quarter ago.

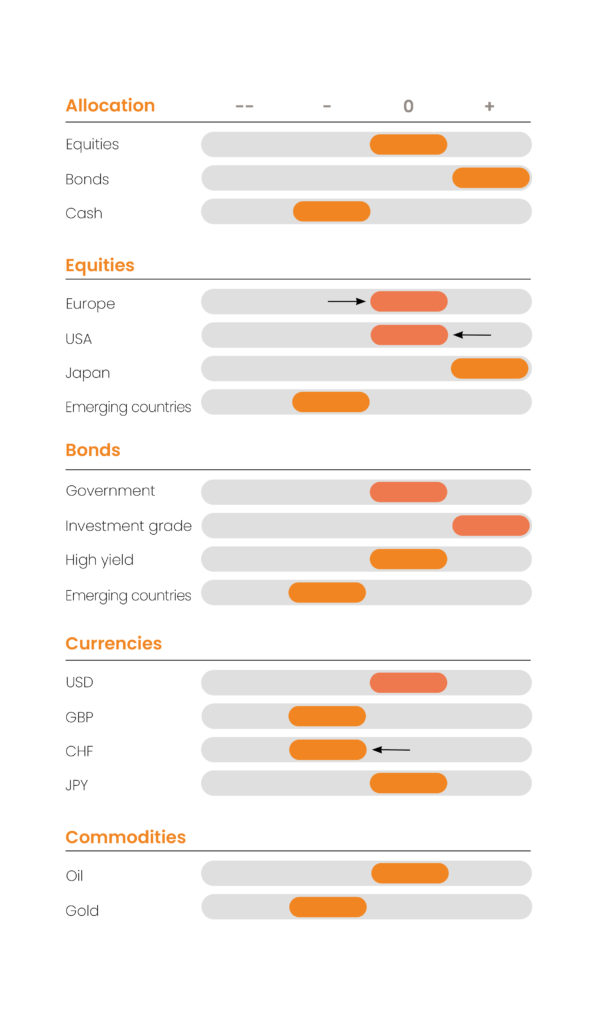

In terms of equities

The next few weeks could see a return of volatility in the equity markets due to the latest central bank meetings at the end of the year. We believe in staying very mobile. We maintain a neutral position given our macroeconomic scenario, which is betting on a gradual disinflation over 2023, while being more cautious in the short term.

In geographical terms, we are rebalancing our view between the United States and Europe.

Recent political developments in Europe, the decline in commodities (especially energy) and a possible reopening of China are reassuring catalysts. In addition, the added value of the European market and higher dividends can be a definite advantage at the end of the year. The only uncertainty remains the peak of inflation which is still not reached and which could push the ECB to act in a more important way. The financial sector (banks and insurance) continues to be favored in these conditions. The US market is expected to be more volatile as central bankers make hawkish speeches. However, in reality, the FED will be more accommodating in the coming month. The evolution of margins represents the greatest source of uncertainty as far as fundamentals are concerned, but a restocking (linked to inventories that are still too low and the normalization of supply chains) and the level of valuations (which should stop deteriorating given the FED’s pivot point) should be a positive element.

We favor stocks capable of maintaining high margin levels that have pricing power and strong balance sheets.

The technology sector, contrary to our expectations, continues to suffer from deglobalization-related disaffection. We favor more moderate capitalizations in this segment.

We will avoid unprofitable companies and stocks with vulnerable margins.

As for China, while a reopening of the Chinese economy is very likely, the timing remains uncertain. Demonstrations broke out in several cities across the country last weekend, with slogans of rare hostility towards the Chinese president and the Chinese Communist Party. In the short term, we don’t know if this will accelerate the movement of Zero Covid policy relief or create an additional crisis. We prefer to stay away for now. We favor indirect exposure via players who actually operate in the country and whose revenues have been significantly impacted by Covid’s policy (e.g., Luxury Goods).

In geographical terms, Japan will benefit from the reopening of the Chinese economy and stronger growth due to a catch-up effect. We still favor Japanese stocks in local currency.

After the Fed’s pivot, we expect a rebound in emerging assets. The rate hike cycle of emerging banks has ended, unlike in developed countries. However, a change of sentiment in the growth dynamic is needed. If these catalysts materialize, emerging equities should outperform developed markets and emerging market debt denominated in local currency should become increasingly attractive. The outlook for emerging market equities in 2023 is challenging: slowing growth, uncomfortably high inflation, and geopolitical risks remain. These risks are not specific to emerging countries and we continue to believe that the stocks of these countries have too much beta for the time being. It is still too early and let’s wait for more favourable months to reposition ourselves.

In terms of fixed income

Recall that at the beginning of the year, the yield on five-year euro-denominated investment grade bonds was 1%, including 0% for the benchmark German sovereign bond rate and a 1% credit spread. Today, the rate is 4%, with a 2% credit spread. We believe that in the first quarter the Fixed Income asset class should be favored, as rate hike expectations incorporate a very large part of central bank action. Credit markets have improved significantly since spreads peaked in the second half of October. We expect spreads to hold through the end of the year but to narrow during 2023 by about 100bps adding capital gain to the current yield. For the time being, we favor investment grade and high yield (BB+). Given the deceleration of global growth and the expected decline in earnings in the first half of 2023, the latter should outperform. We maintain our positive view overall. Crossover bonds are still particularly attractive, although we may still see some volatility, as we have seen in equity markets. The headwinds should diminish during 2023, allowing the business cycle to improve and the risk exposure in portfolios to gradually increase.

We favor companies with strong balance sheets and a high level of cash generation. After one of the worst years in terms of performance and a very high correlation with the equity markets, bonds are regaining their qualities as a diversification tool in portfolios thanks to the profitability cushion acquired at the end of the year. A scenario of a moderate recession should benefit the fixed income asset class over 2023, which could be a mirror image of 2022. Uncertainty about the Fed and higher than expected inflation have been the main factors widening IG spreads in 2022. In contrast, the decline in Fed uncertainty should allow IG spreads to tighten despite somewhat weaker credit fundamentals next year.

At the level of foreign exchange

In terms of currencies, we remain negative on the GBP: the equation looks more unfavorable given the risk of the UK’s twin deficits worsening sharply in the coming quarters. The Japanese Treasury’s interventions should contribute to some stability in the yen. For the dollar, we thought the 1/1.05 range was at an adequate level. A further decline in US inflation and a willingness to talk by the ECB should allow the US currency to stabilize and then decline in the second half of the year (our year-end target is 1.08). The US currency remains the main safe haven against accelerating inflation or a globalization of the Ukrainian conflict. The CHF should depreciate as geopolitical risks are reduced and the ECB becomes more restrictive on inflation.

MACROECONOMIC UPDATE

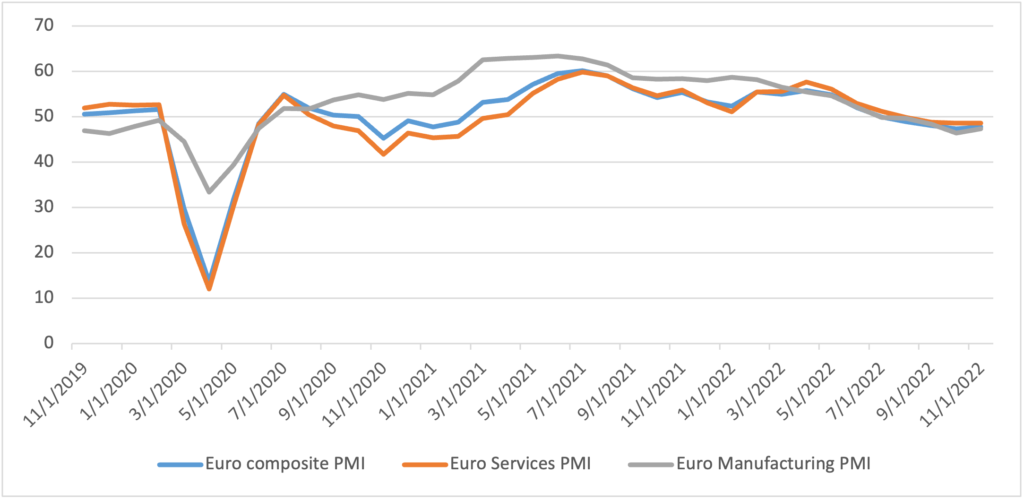

European growth is contracting

The preliminary PMI indices for November once again confirmed the clear slowdown in activity in the euro zone. The composite PMI index is in contraction territory for the fifth consecutive month but with no further deterioration, probably linked to fiscal support and more favorable weather conditions. The price subcomponents of the PMI indices have resumed their slowing phase, in part due to the decline in energy prices seen since the summer and the continued improvement in supply chains. ECB Vice President Luis de Guindos believes that inflation should peak in the first quarter of 2023 before prices continue to slow next year. While the Vice President emphasized the impact of the recession and the ECB’s action on prices in 2023, the work is still far from over, especially given the underlying inflationary pressures that will remain strong in a context of “second-round effects” that are materializing more and more strongly. Indeed, significant wage increases are being implemented in all four corners of the euro zone. The agreement at Volkswagen to increase wages by 8.6% by 2024 (following the main principles of the IG Metall branch agreement) illustrates this price-wage loop, which will continue in part next year. In this context, the risk of second-round effects and de-anchoring of inflation expectations remains high according to ECB members, who, after having taken monetary policy sufficiently into restrictive territory with an increase in key rates to levels close to 3% and a reduction in the size of the balance sheet via maturities, will keep it unchanged for several months, fueling upward pressure on European sovereign rates.

Sources: Bloomberg & Richelieu Gestion

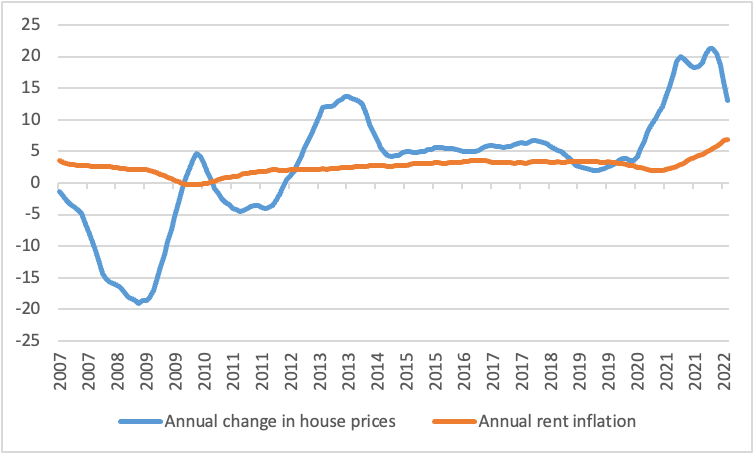

US real estate is slowing down and that’s a very good thing for now!

Recall that the housing market has benefited from abundant liquidity since 2020. The Standard & Poor’s Case-Shiller Index, which measures the face value of the residential real estate market in 20 U.S. metropolitan areas, rose 44% from March 2020 to June 2022. While this 17% annualized increase enhances the wealth effect, it is not without negative consequences. Rents as well as sales prices have risen due to the historic liquidity injected by the Fed over the past two years. The overall CPI weighting reflects that housing accounts for 33% of the CPI, the largest weight of any category. Thus, housing has a significant impact on overall inflation from month to month.

The U.S. Bureau of Labor Statistics breaks down the “housing” category into four components: rent, out-of-home accommodation (e.g., hotels), renters’ and households’ insurance, and homeowners’ equivalent rent. Rent and “owners’ equivalent rent” are by far the most important. Housing activity has declined for nine consecutive months, with home sales down 28.4% in October from a year earlier. Aggressive monetary tightening by the Fed has pushed the average 30-year U.S. mortgage rate from 5.60% to 6.84% over the past three months. The decline in home purchases is one of the effects and objectives of the tightening of monetary policy, as housing is an interest rate sensitive sector. The warnings from the real estate sector are getting stronger with the new drop in the indicators of the builders’ association, the NAHB, for which the impact of the increase in interest rates is of a rare violence, which even the crisis of 2008 did not generate. Housing prices have not yet fallen much due to a relatively low supply, but we expect the movement to accelerate in the next month. The decline since July has led to a moderation in home prices and rents in many parts of the United States. The typical sales price, $359,000, was down more than 8% from its June peak of $392,000, according to Redfin.

For now, the decline in rents and house prices is not really impacting inflation because of a lag. Historically, the CPI for “housing” lags house price changes by four quarters, suggesting that housing will continue to exert upward pressure on overall inflation through the first half of 2023 (the lag effect is largely due to the time it takes for leases to roll over into a new contract). As the housing market cools, its share of price increases will also diminish, but it will take until next year to significantly dampen overall inflation. Stabilizing or lowering real estate prices is a difficult art and obviously carries a substantial risk to growth and even to the financial system. The risk of a real estate crisis is possible, but we believe that we are in a totally different configuration from 2006-2007. Real estate debt remains under control and does not constitute a systemic risk for the banking system but an effect on consumption.

Sources: Bloomberg & Richelieu Gestion

MARKET POINT

China: a reopening that is not so simple

Approximately 25% of the population in Europe and the United States was infected in the first six months of the Omicron spread, suggesting that China is facing 363 million infections in the same period. There are several key differences in China – including the much lower level of immunity and demographic variables – that increase the risk of a much higher level of infection.

Despite the lack of central government-imposed containment measures, most regions are not allowing infections to spread unchecked, which would lead to a massive wave of infections: Hong Kong’s main omicron wave peaked at 10,300 infections per 1 million people on March 3. But the problem with local infection control is that it will only prolong the period of full reopening to more than a year, or even longer, until the population learns to live with the virus.

The euphoric reaction to China’s softening of its position on zero Covid-19 seems misplaced, given that full reopening could result in 5.8 million ICU admissions. To avoid this, continued caution will be needed in many parts of China, but this will extend the time of full reopening beyond 2023. China does not need mRNA vaccines; it just needs more boosters.

At this point, we do not know if the protests in China will speed up the process of reopening the Chinese economy or, conversely, bring about an episode of increased stress for the next few months.

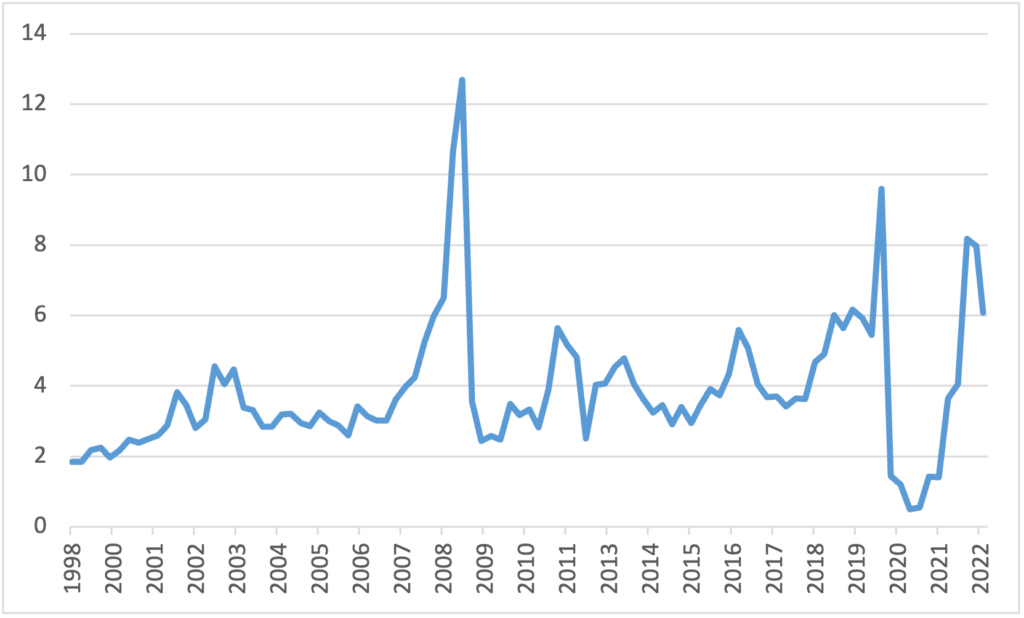

Euro zone rates: a fragile easing of spreads on sovereigns

The tightening of peripheral rates suggests a return of risk appetite in the Eurozone despite the ECB’s restrictive stance and larger fiscal imbalances. The implementation of certain structural reforms will be important to maintain market confidence and give governments time to reduce public deficits. The Italian 10-year spread has thus compressed to around 180 basis points, the lowest level since last April and well below the 240 basis points recorded after Giorgia Meloni’s victory in the September legislative elections. However, it seems to us that this tightening goes beyond the fundamentals, even though the latest economic figures in the Eurozone turned out to be better than expected. Monetary and energy shocks traditionally have a lagged effect on activity and the economic environment could therefore remain difficult in the coming year. In addition, Eurozone inflation, unlike in the US, has not yet peaked and there is a broad consensus within the ECB that monetary policy is still accommodative. This increases the risk of higher than expected rate hikes. Third, the ongoing fiscal support to protect households from the energy shock implies higher public debt for several countries. All these elements are potential sources of rate volatility.

In Italy, the government is now forecasting a budget deficit for 2023 of 4.5% of GDP. As a result, the Debt/GDP ratio is not expected to improve next year, stabilizing at around 145% compared to less than 70% for Germany. In theory, such a gap would justify Italian spreads at 200 basis points or more. Maintaining market credibility will therefore require some structural reforms. For Italy, this means making progress on pension and competitiveness reforms. Both of these issues have been postponed by the new government until now. The ECB is committed to fighting inflation, while fiscal support from EU governments is fueling inflation. The impact of new government debt issues could be a source of additional volatility on long maturities.

We continue to favor short duration in sovereign bonds, before finding opportunities in long maturities in early 2023.

Sources: Bloomberg & Richelieu Gestion

Banking & Insurance sector: a sector still value

We believe that the disinflation phase has begun in the US, although the risk of inflation persists. We expect European sovereign rates to peak in Q1 2023 and not at the end of 2022, as the situation in Europe is more complicated with exogenous risks that remain far from being resolved. Against this backdrop, we continue to favor European banks and insurance companies (especially within the equity asset class), which should continue to attract investors as the year draws to an end. We believe that banks are a good hedge against hawkish central banks, as they benefit from a higher NIM (net interest margin).

We believe that this effect will be more important than the concern about the risks of lower credit growth. The European Central Bank will continue to raise interest rates until inflation returns to the medium-term target. Given the reduced risks of a deep slowdown and persistent inflation, we now expect hikes through May, with a peak of 2.75%/3% for the ECB for the deposit. For now, risk management is under control and the efforts made over the years have strengthened their balance sheets and operations. The European Central Bank, however, is expected to increase its capital requirements for banks that have not complied with its advice to reduce their activities in leveraged loans.

The insurance and reinsurance sector should also benefit from the rate environment. Between rising weather claims and the emergence of new risks, as well as the aftermath of the war in Ukraine, the reinsurance industry is expected to have a challenging 2022. But reinsurers could raise premium rates in the “single-digit” percentage range in the key January 1 renewal season, given the pressures of inflation, the war in Ukraine and volatile capital markets. Dividend yields are sustainable and strong for the next several years.

Sources: Bloomberg & Richelieu Gestion

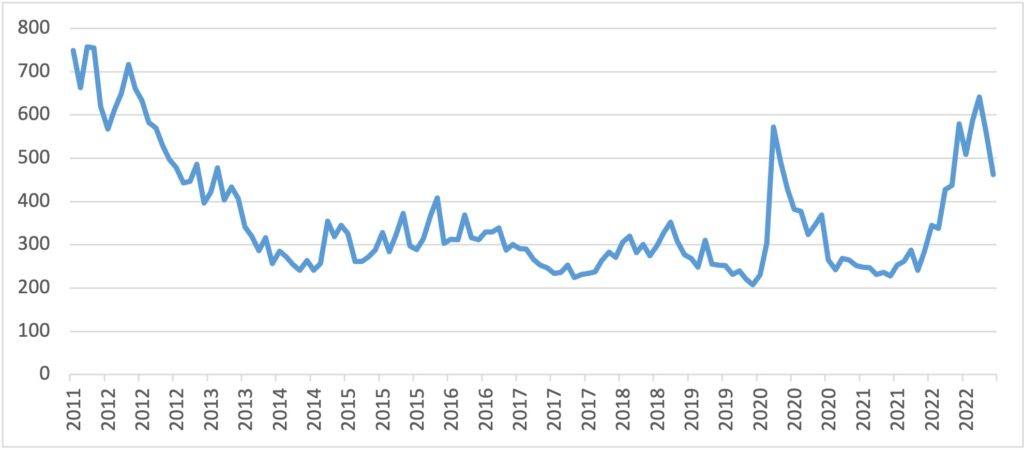

Credit: crossover and IG bonds still preferred

Higher-than-expected inflation figures, particularly in the US, have been one of the main drivers of the widening of credit spreads this year. Credit markets have improved significantly since spreads peaked in the second half of October. We expect spreads to hold through the end of the year and to tighten through 2023. We judge the recent improvement to be not just a seasonal performance but rather a real change in the market trajectory, given the high levels of uncertainty in market sentiment that are improving. Flows are gradually returning to the asset class and should attract investors as the inflation outlook moderates. Real yields have increased across all bond categories, opening up opportunities that investors have not seen in many years. Interest rate levels are providing a better return on risk.

Euro IG has been the worst performing market in the bond asset class this year, but we believe Euro IG is likely to outperform in 2023. We believe that Euro IG will generate appreciable total returns. At the beginning of a recovery, IG spreads tend to tighten faster than HY spreads. We also believe that European IG spreads could tighten relative to US IG, primarily due to valuation. Europe’s credit quality is superior to that of the US, with more companies rated BB (70.7% in Europe vs. 52.3% in the US) and fewer companies rated CCC and below (5.5% in Europe vs. 11.1% in the US), even allowing for the possibility that the European economy could experience a sharper slowdown. Crossover bonds are particularly attractive even though we may still have some volatility. Default rates will certainly rise but forward yields over a 4/5-year horizon are particularly attractive. We favor companies with strong balance sheets and high levels of cash generation. The new refinancing levels will weaken companies with too much balance sheet leverage (rating below BB). Flows to IG credit have picked up since the summer. This is probably due to the fact that spreads have widened to levels that have only been seen once in the last decade, outside of Covid. It is also worth noting that October was the first month of the year where flows into HY were positive, which may indicate that investors are willing to increase credit risk.

Sources: Bloomberg & Richelieu Gestion

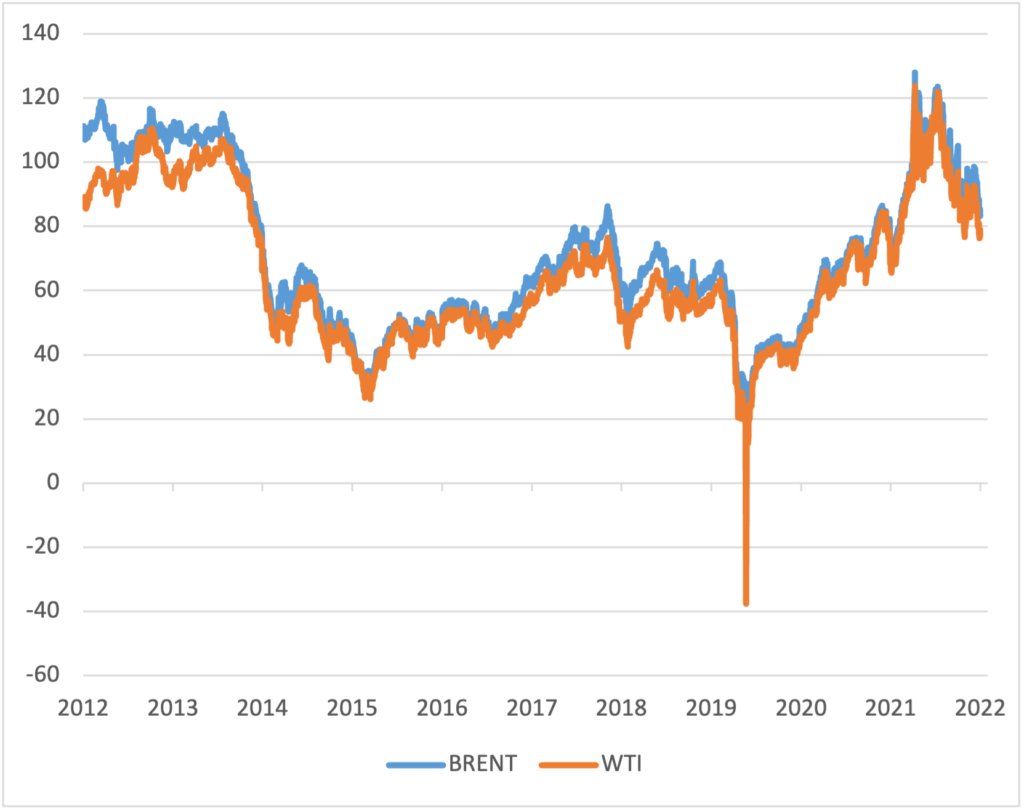

OIL : a geopolitical asset

Brent is under heavy pressure at the end of the month. Fears about demand from China, with rising social tensions in protest at Beijing’s health restrictions, are resurfacing. The agreement finalized between the United States and Venezuela provides that the American oil major Chevron can resume the extraction of crude in Venezuela, with a license of six months for now, in partnership with the national company PdVSA. This development is a reminder of Washington’s desire to secure other sources of crude oil supply after not being heard by OPEC and in particular by Saudi Arabia, especially since new Western sanctions against Russian oil (halt to European imports, price cap for other countries) are due to come into force in December.

However, this change should not be over-interpreted at this stage, given both the size of the additional production potentially generated in the short term (around 0.2 mb/d) and, above all, OPEC’s ability to potentially neutralize it quickly if the cartel were to agree on an additional production cut. In any case, we consider that OPEC will remain supportive of crude prices in the coming months. Over the next few months, prices should stabilize and bring a significant base effect on inflation. The gradual reopening of the Chinese economy will fuel a recovery in global demand for crude in 2023, allowing Brent to return to around $100/barrel. Between the start of the war in Ukraine and September, the sale of oil and gas brought in 158 billion euros for Moscow, according to the think-tank Center for Energy and Clean Air Research (CREA). Two-thirds of its revenue comes from crude oil and refined products. If no agreement is reached on the G7 proposal to cap the price of Russian oil, the EU members will apply a much tougher measure, which they agreed on in May: a total ban on the import of Russian crude oil from December 5 and of Russian refined products from February 5.

Sources: Bloomberg & Richelieu Gestion

Synthesis Strategy Richelieu Group – Author

Disclaimer

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

The information, opinions and estimates contained in this document are for information purposes only. No element can be considered as an investment advice or a recommendation, a canvassing, a solicitation, an invitation or an offer to sell or to subscribe to the securities or financial instruments mentioned. The information provided concerning the performance of a security or financial instrument always refers to the past. Past performance of securities or financial instruments is not a reliable indicator of future performance.

All potential investors should conduct their own analysis of the legal, tax, accounting and regulatory aspects of each transaction, if necessary with the advice of their usual advisors, in order to be able to determine the benefits and risks of the transaction and its appropriateness to their particular financial situation. He does not rely on Richelieu Gestion for this.

Finally, the content of the research or analysis documents or their excerpts, if any, attached or quoted, may have been altered, modified or summarized. This document has not been prepared in accordance with the regulatory provisions designed to promote the independence of financial analysis. Richelieu Gestion is not prohibited from trading in the securities or financial instruments mentioned in this document prior to its publication.

Market data is from Bloomberg sources.