Should we be afraid of AI in portfolio management?

By Nicolas Touvet, Head of Asset Management

Artificial intelligence is already present in many fields, including voice assistants and chatbots for customer communication, search engines and product recommendations for online commerce, autonomous vehicles for transportation, surveillance systems for security, image recognition for healthcare, financial services for fraud detection and risk analysis, recommendation systems for entertainment and media… These examples are just a small portion of the areas in which AI is already present and expanding. But since November 2022 in a free, non-internet connected version, through ChatGPT, developed by the start-up OpenAI and enjoying wide media exposure, artificial intelligence has entered the public domain. What about the portfolio management field ?

Artificial intelligence (AI) is having an increasing influence on management decisions in the stock market. AI algorithms can help analyze massive amounts of financial data in real time, detect patterns and trends, identify trading opportunities and optimize investment decisions.

The use of AI for portfolio management and investment decision making has increased dramatically in recent years. Large financial institutions use algorithmic trading systems to execute transactions at high speed and with great accuracy. Portfolio managers can also use AI algorithms to optimize their portfolios, based on their goals and risk tolerance.

AI can also help predict future business performance by analyzing financial data and market trends. Machine learning models can identify factors that affect a company’s financial performance and predict how it will perform in the future, but they can also be influenced by biased data or unexpected events that are not taken into account in the model.

AI therefore has an increasing influence on management decisions in the stock market. While it offers many benefits, it also presents risks and regulatory challenges. Investors and portfolio managers must therefore be aware of these risks and ensure that AI is used responsibly and ethically in their investment decisions.

Can AI predict everything?

No, don’t we say that there is no such thing as a martingale in the stock market (see insert). While AI is capable of processing massive amounts of data and detecting patterns that can help predict future trends, it cannot predict the future with absolute certainty!

Machine learning models used in financial applications can be influenced by historical data that may not reflect future events. In addition, economic, political, and social factors can change rapidly and unpredictably, making it difficult to predict long-term trends.

In addition, investment decisions can be influenced by factors that cannot be easily quantified or measured, such as consumer trends, a company’s reputation or changes in government regulations. Ultimately, AI can provide useful information and insights to help make investment decisions, but it cannot completely replace human judgment and experience. Investors and portfolio managers should therefore use it with caution and with an eye to the limitations of the technology.

A martingale is a gambling or investment strategy based on the idea that previous outcomes of a random event have no bearing on future outcomes. In other words, a martingale assumes that if you keep betting on the same random event with the same bet, you will win sooner or later…

For example, let’s say you’re playing roulette and you always bet on red. If you use a martingale strategy, you would double your bet every time you lose until you eventually win. This strategy is based on the assumption that if you play long enough, you will eventually win, and that your winnings will offset any losses you have incurred up to that point.

It is important to note that this assumption is false in many cases, as random events can be influenced by external factors such as chance or systematic errors. As a result, martingale strategies can often lead to significant losses if used carelessly.

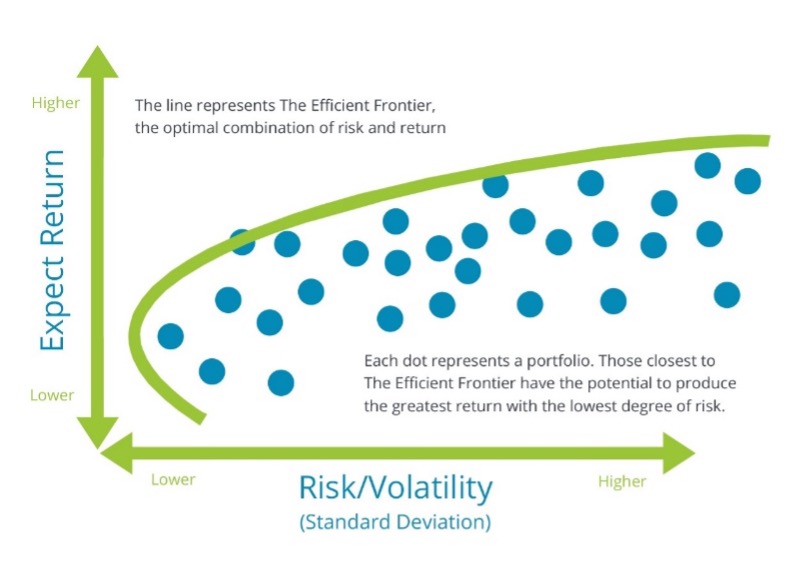

Already in its time, the theory ” modern portfolio “, a financial theory developed in 1952 by Harry Markowitz, could be used to optimize the allocation of an investment portfolio by maximizing the expected return while minimizing the risk.

This model does not directly predict stock price movements, but rather uses historical data on the returns and risks of different financial assets to calculate the correlations between these assets and construct a diversified portfolio.

The Markowitz model is a proven method for building well-diversified and balanced portfolios, but it does not guarantee a positive return or protection against market losses. Indeed, the real performance of a portfolio depends on many factors such as economic conditions, market trends, geopolitical events, increasingly unfathomable monetary policy decisions, or an unexpected corporate governance event. It should also be noted that this model is based on simplifying assumptions, such as the normality of return distributions and the absence of transaction costs. These assumptions may not be fully realistic in practice, which may affect the actual performance of the portfolio.

The Markowitz model is therefore a useful method for constructing well-diversified portfolios, but it cannot directly predict the evolution of the stock price. This leads to the same conclusion as with artificial intelligence : Investors should use this method in combination with other analyses and their own judgment to make informed investment decisions.

Is the human being still indispensable to manage a portfolio ?

While AI can provide useful analytics and insights to help make investment decisions, the human being remains indispensable to manage a portfolio in a global way. Investing is a complex and evolving business, and portfolio managers must use their judgment and expertise to evaluate and take into account a variety of non-quantifiable factors, such as a company’s reputation, consumer trends, macroeconomic factors, and geopolitical events.

In addition, client relationships are an important aspect of portfolio management and it is essential to understand each client’s needs and objectives in order to provide personalized advice and solutions. Ultimately, AI can be a valuable tool to help portfolio managers make informed investment decisions, but it cannot completely replace human expertise and experience.

What to think about robot advisors for portfolio management?

Robo advisors are online platforms that use algorithms to provide investment advice and manage portfolios in an automated way according to given risk profiles. They are becoming increasingly popular because They offer a less expensive and more accessible alternative to traditional portfolio management.

Robotic advisors are also able to monitor and automatically adjust portfolios according to market fluctuations.

However, while robo-advisors may offer advantages in terms of cost and accessibility, they are not suitable for all investors. The latter have complex investment objectives or broader financial planning needs and therefore require human expertise for more personalized and holistic portfolio management, taking into account their tax situation for example.

What about algorithmic trading?

Algorithmic trading is a common practice in the financial markets, where computer algorithms are used to make automated trades. Algorithms can be designed to make buy or sell decisions based on criteria such as market trends, price patterns, economic news and technical indicators.

Algorithmic trading is becoming increasingly popular due to its potential benefits, including speed, efficiency and accuracy. Algorithms can trade at a much higher speed than humans, which can be an advantage in a market where price fluctuations can occur in milliseconds. In addition, algorithms can analyze complex data in real time and make trading decisions accordingly, which can lead to better performance than manual trading.

However, this type of trading can also be risky. Algorithms can be subject to programming errors or bad data, which can lead to significant losses. Algorithmic trading can exacerbate market movements when a large number of algorithms react to the same market events simultaneously, which can lead to significant volatility effects.

Ultimately, algorithmic trading is a common practice in the financial markets, but it is important to understand the benefits and risks before deciding to use it. Investors should be aware that this type of trading is not infallible and that it is important to constantly monitor the performance of their trading strategies.

Finally, the manager remains at the heart of the customer relationship…

While AI technologies can provide valuable insights and analytics, they cannot replace the value of a trusted human relationship.

Portfolio managers play an important role in managing client expectations, communicating risk and assisting with investment decisions. Clients may have different needs and specific investment objectives, which require a personalized approach to managing their portfolio.

The portfolio manager can help clients understand the risks and rewards of different investment strategies, determine their risk tolerance and identify appropriate investment objectives. The manager may also provide advice to adapt the investment strategy to changes in the market and the client’s needs. Ultimately, the relationship between the portfolio manager and the client is based on trust and open communication.

There are many statistics and figures that support the importance of the client relationship in portfolio management and the impact of AI on management decisions in the stock market. According to a 2019 Deloitte study, 60% of online investors surveyed said they would rather work with a financial advisor than use an automated online portfolio management platform, that was 4 years ago! And according to a 2020 Capgemini study, 78% of private banking and wealth management clients said relationships with their advisor were important to them. Finally, algorithmic trading accounts for a significant portion of the volume of transactions on the financial markets. According to a report by the Association for Financial Markets in Europe (AFME), algorithmic trading accounted for 40% of total trading volume in European markets in 2018. In the United States, it accounts for approximately 60 to 73% of global US equity trading (source: Wall Street).

This data suggests that while AI and algorithmic trading technologies are becoming more prevalent, many clients still value the human relationship with their financial advisor and that’s good!

Richelieu Gestion | Focus – May 2023

This document is intended exclusively for the person to whom it is given and may not be transmitted or made known to third parties. Past performance is not indicative of future performance and is not constant over time. This document is non-contractual, it is only written for general information, discussion and for information purposes only. This information should not be considered as an offer, an investment research and does not constitute a recommendation to buy or sell any investment or financial product or service. We draw your attention to the necessity and importance of reading the Key Investor Information Document (KIID), a copy of which is available on the website www.richelieugestion.com