Lithium

By SébastienMazille, Assistant Manager GSM

The transition to greener modes of transportation is a major focus of governments and major cities to reduce the carbon footprint. The electric car (EV) is one of the solutions already widely adopted by most developed countries. Europe, for example, has set a deadline of 2035 for new cars to go all-electric. Although this objective is opposed by certain countries such as Germany, Italy and Poland, it illustrates Europe’s desire to transform its vehicle fleet.

Early electric car manufacturers like Tesla are obviously benefiting from this transition, but many other companies in the EV production chain are also benefiting. In particular, the battery represents a significant part of the total production costs of an electric car. Upstream of the production chain, raw materials such as cobalt, graphite or lithium have seen their demand increase sharply in recent years. Lithium has attracted particular attention in recent years.

What is lithium ?

Lithium is a soft metal that is highly coveted by many industries, especially for electric batteries. It is the 33rd most abundant element on earth, however the difficulties of extraction perfectly justify its nickname ” white gold “. Lithium does not exist in its natural state, it is extracted mainly from certain types of rocks, clays and brines.

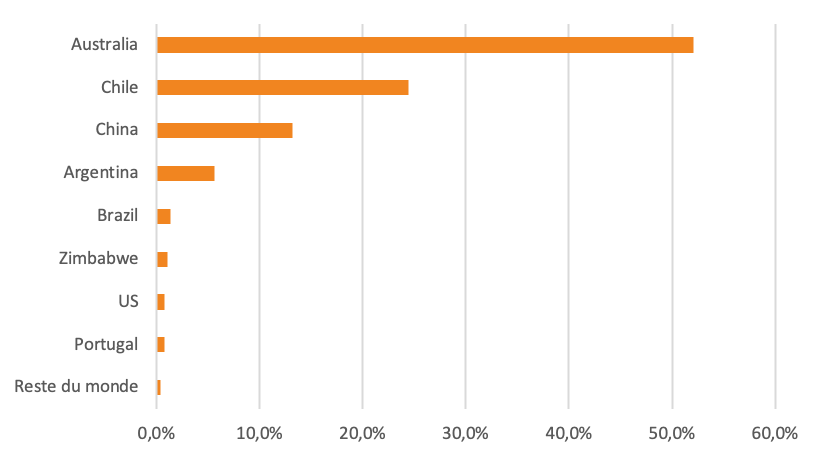

The extraction of the rock mines is mainly done in Australia (first producer with 52% of the world productions) and in China. To extract lithium from rocks, the rock must first be crushed and water added to form a paste that will separate the lithium from the rock. The Lithium powder will then be heated to extract the “pure” mineral. This process, which takes between one and two months from the crushing of the rock to the recovery of the final raw material, is costly due to its high consumption of water, chemicals and energy.

Sources: Bloomberg, Richelieu Group

The extraction of brines is mainly done around the ” lithium triangle” in the salt deserts of Argentina, Bolivia and Chile. This method of extraction is less expensive but takes between 12 and 24 months and requires large quantities of water. According to a report by the United States Geological Survey (USGS), the subsoil of the Golden Triangle contains no less than 56% of the 89 million tons of lithium identified in the world.

How to reduce its environmental impact?

Lithium is an essential mineral for the energy transition, but its extraction process raises social and environmental issues. For example, the Salar de Atacama region in Chile is very dry. SQM (one of the two companies authorized to operate in the desert) uses in 2022 nearly 400,000 liters of water per hour for the needs of its plant in the country. The high resource intensity required for lithium extraction therefore brings risks of water stress, land use and pollution.

Battery recycling is one of the major challenges in reducing the environmental impact of lithium. Its process starts with the disassembly of the battery and the separation of the different components, such as lithium, cobalt and nickel. Lithium can then be extracted using chemical or pyrometallurgical techniques. Chemical techniques involve the use of solvents to dissolve lithium from the electrodes, while pyrometallurgical techniques involve melting the battery at high temperatures to recover the metals.

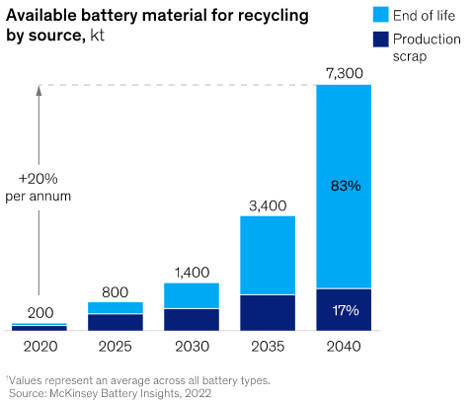

In a study, McKinsey predicts that the entire lithium-ion (Li-ion) battery chain, from extraction to recycling, could grow by more than 30 percent per year by 2030. However, the small amount of lithium recovered from used batteries and the high cost of recycling will be the main challenges in the coming years to sustain this sector. An 80% recycling target by 2030, as recently specified in the European battery directive, could become an aspiration for other regions of the world. In addition, the amount of batteries to be recycled will increase as the first generations of electric cars are replaced. McKinsey estimates the amount of batteries available for recycling at 7.3 million tons in 2040, compared to 200 000 tons in 2020.

Finally, some companies are investing heavily in developing new extraction techniques known as direct extraction, DLE. As its name suggests, this technology allows the lithium to be extracted directly from the brine using membranes without the need to evaporate it. This technique aims to accelerate production and above all to considerably reduce the environmental footprint of lithium extraction.

Who are the main actors?

The global lithium market is consolidated, with production concentrated in the hands of a few key manufacturers. Albemarle, SQM, Livent Corp, Ganfeng Lithium Co, Allkem Limited and Tianqi Lithium are among the world’s leading producers.

Source : Richelieu Gestion

Global demand

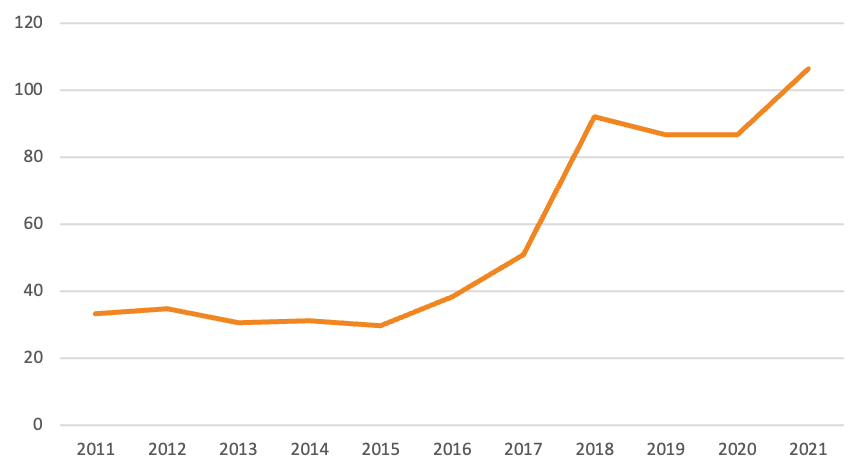

Some countries started to extract lithium after the Second World War. Between 1955 and 1980 the average annual production was 5 000 tons per year. In 2021, overall production was 106,000 tons with an average growth of 37% per year since 2015. With the meteoric rise of electric car production, production will continue to accelerate in the coming years. The research agency S&P Global estimates global demand at 2 million tons by 2030.

In thousands of tons

Source : BP Statistical Review of World Energy 2022

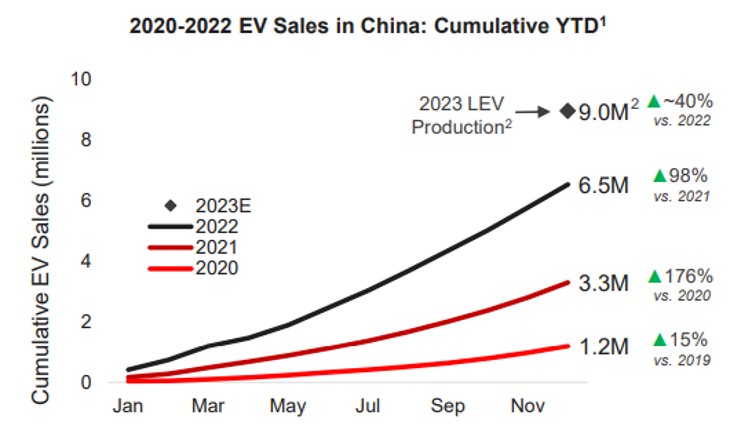

The growth in demand for lithium is therefore strongly correlated with sales of electric vehicles, supported by new regulations in favor of sustainability. These include the European “Fit for 55” program, the U.S. Inflation Reduction Act, the 2035 ban on internal combustion engine (ICE) vehicles in the EU, India’s “Faster Adoption and Manufacture of Hybrid and Electric Vehicles Scheme”

The American lithium leader Albemarle has recently increased its estimates of electric vehicle sales in China, which is by far the largest EV producer in the world.

Strong demand, but at what price ?

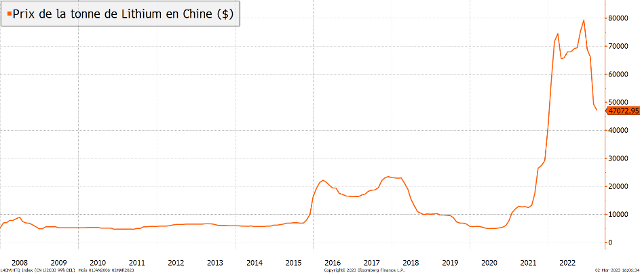

Despite an acceleration in global production, supply will not keep pace with demand. Indeed, the price of lithium has risen sharply in recent years. China’s Lithium Carbonate Index ” pure ” has risen from an average price around $20,000 per ton in 2018 to almost $80, ,000 by the end of 2022.

In thousands of tons

Sources : Bloomberg, China Lithium Carbonate 99% DEL

This tension on lithium prices is a concern for battery manufacturers and carmakers like Tesla, which is reportedly considering the acquisition of a Brazilian lithium giant, Sigma Lithium.

CATL, one of the world’s leading battery manufacturers (37% of global sales), is taking advantage of this opportunity to gain market share by selling batteries that are significantly less expensive than its competitors , even if it means cutting its margins. These new contracts have actually lowered the price of Chinese lithium in 2023, although ” these knock-down prices ” are only offered to some of its ” best customers ” Chinese in exchange for an 80% supply commitment.

Global lithium reserves are theoretically sufficient to meet the expected increase in demand. In practice, all these reserves should be able to be put into production and the quality of the latter should be in line with the standards of the battery industry. Despite a divergence of analysts on prices as well as on the environmental impact of lithium, there is no doubt about the inability to meet the high demand of the coming years with the current production capacities. The white gold market should therefore experience very dynamic growth in the medium and long term. In view of this, major R&D expenditure will be devoted to optimizing the extraction of the raw material (the ” DLE ” extraction is a good example), but also to the search for alternative solutions to diversify the modes of transport of tomorrow (hydrogen, biofuels, natural gas, etc.).

Richelieu Gestion | Focus – March 2023

This document is intended exclusively for the person to whom it is given and may not be transmitted or made known to third parties. Past performance is not indicative of future performance and is not constant over time. This document is non-contractual, it is only written for general information, discussion and for information purposes only. This information should not be considered as an offer, an investment research and does not constitute a recommendation to buy or sell any investment or financial product or service. We draw your attention to the necessity and importance of reading the Key Investor Information Document (KIID), a copy of which is available on the website www.richelieugestion.com