The presence of oil stocks in sustainable funds: why and how?

By Stanislas Duval De La Guierce, Sustainable Finance Manager

Numerous reports, including that of the IPCC, confirm that climate change is unprecedented, and that the role played by human activity is indisputable. Since the Paris Agreement at COP 21 adopted in 2015, all signatory countries have been planning their greenhouse gas emission reductions. These emissions come from primary energy sources, of which oil and natural gas are the most polluting, just after coal.

This agreement has put the spotlight on sustainable finance ; the number of ” sustainable ” assets has increased, as the implementation of multiple regulations. Investment funds ” durable ” or ” ESG ” (Environment, Social and Governance) have gained momentum over the last ten years. Their names indicate that they invest in companies that respect the environment without forgetting the social impact, so as to be aligned with climate objectives. At first glance, the presence of oil companies in these funds seems contradictory. There are, however, some nuances that come up against reality. Indeed, in order to meet emission reduction targets while maintaining economic and social stability, we are talking about a transition to a more sustainable world.

This nuance between alignment and transition can be found in European regulations, for example in the two types of European climate index. These are called “Paris Agreement” indices (PAB), which exclude companies exposed to fossil fuels, and “Climate Transition” indices (CTB), which include them. The regulations therefore imply that oil industry companies cannot be aligned with the Paris Agreement, but for economic and social reasons, can participate in the transition.

Transition: environment vs. social vs. economic

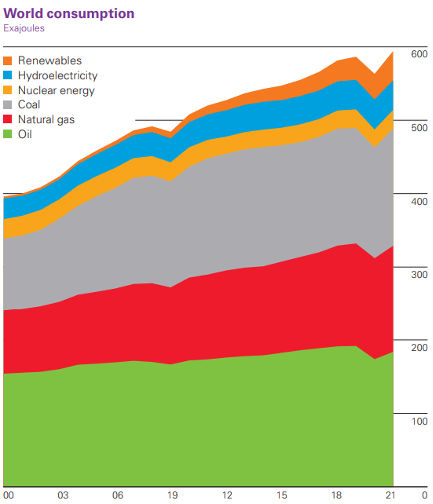

This transition comes up against many opposing environmental, social and economic considerations. We need to strike the right balance between meeting rising global energy demand and solving the problems caused by fossil fuels. These are currently the main source of energy. Worldwide, they account for 82%1 of primary energy sources, including 31% oil and 24% natural gas.

Source: BP Statistical Review of World Energy, June 2022

These fossil raw materials are extracted mainly for energy purposes, but not exclusively. For example, crude oil is 86%2 used for fuels (diesel, kerosene, etc.), while the remainder is used to produce plastics or asphalt.

As a result, without a controlled transition, rising demand and the restriction of fossil fuels will drive up prices, and households, especially the poorest, will suffer.

Adaptation and geopolitics

Adaptation is also necessary for two closely related reasons: geopolitics and resource depletion. For this is referred to as peak oil. This is the peak of the global oil extraction curve. Estimates of global peak oil are regularly updated by specialized research organizations. This is due to the gradual discovery of new deposits. Some of Europe’s supplier countries have already reached their peak, such as Algeria in 20073. The Old Continent is the world’s third largest consumer by volume, behind China and the United States, as well as the world’s largest importer of crude oil. This situation can be explained by both the number of inhabitants and the level of economic and industrial development. This is how geopolitical issues come into play, most recently with the Ukrainian conflict. In 2020, Russia will supply 29%4 of all oil imported by the EU. Even today, despite the sanctions, the EU continues to import oil from Russia.

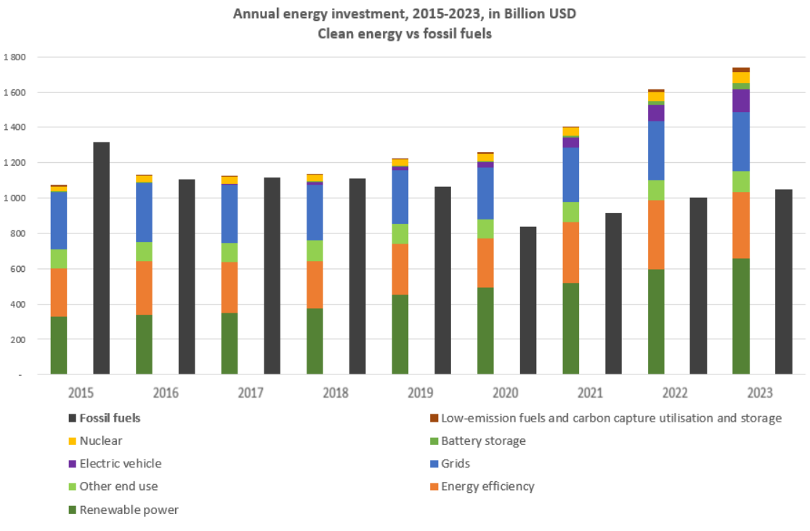

All these challenges are triggering a wave of financing both in fossil fuels (finding and exploiting new deposits) and in green energies (the famous transition). The oil and gas majors are reportedly developing 1955 “carbon bombs” that would shatter climate targets. At the same time, investment in ” green ” energies, in part by oil companies, is increasing rapidly. On a positive note, the International Energy Agency (IEA) estimates that by 2023, investment in solar energy should outstrip that in oil. It should also be noted that the falling cost of renewable energies6 makes them more competitive. IRENA estimated that, given fossil fuel prices, the lifetime cost per kWh of new solar and wind capacity added in Europe in 2021 would be on average at least four to six times lower than the marginal production costs of fossil fuels in 2022.

Source: World Energy Investment 2023

The ” best in class ” strategy

All these issues have an impact on oil stocks, which raises the question : how are they taken into account in sustainable finance ?

The inclusion of oil stocks in ESG investment funds may vary according to the specific criteria used by each fund. Some ESG investors may exclude oil companies altogether because of their environmental and social impacts, as is the case for those wishing to follow the Paris Agreement, while others may include them in their portfolios because of their efforts to transition to more sustainable practices.

The latter use a strategy known as best in class It consists of giving preference to companies with the best extra-financial ratings within their sector of activity, in relation to the defined investment universe. Frequently used by French managers of SRI (socially responsible investment) funds, it enables them to avoid excluding or favoring a particular sector. Ratings are based on multiple sources, including company declarations and reports (CSR policies and reports), plus malus depending on controversy. Company transparency therefore plays a key role in the value of ratings.

This SRI strategy answers the question : which oil companies are best prepared to adapt to the transition to a more sustainable world?

Ratings are based on the environmental, social and governance pillars. The extra-financial rating agencies that produce them do not have the same calculation methodologies, but on the whole they arrive at a similar hierarchy of oil companies. There are three regions : Europe, North America and the other oil superpowers (Russia, China and Saudi Arabia).

ESG

With regard to the Environment pillar, several distinctions between regions are highlighted. Thanks to stricter regulations in Europe, European stocks are tending to become more committed to and involved in various environmental issues. Pollution management with regard to transport and extraction structures, and biodiversity protection top the list. These policies and commitments are challenged by controversies, particularly over water management, which is one of the most common.

One difference concerns the type of extraction. European stocks use less in total proportion7 to non-conventional extraction, which is generally more costly and more polluting than conventional oil extraction. For example, oil sands extraction involves removing layers of earth and sand to access the bitumen, which is then separated and processed to obtain oil. Similarly, extracting shale oil requires fracking techniques (hydraulic fracturing), which are also costly. The latter is widely used in the United States. Some oil companies use fracking almost exclusively, such as Devon Energy Corporation, whose fracking accounts for 96% of its total production8 .

Investing in renewable energies is one of the most popular solutions for European stocks, helping them to make the transition to a low-impact economy. Most companies have started producing biofuels, but it’s mainly European stocks that are investing the most in renewable energies such as solar and wind power. For example, French giant Total Energies is ahead of its European rivals ENI, Shell and BP in the renewable energy race. The giant claims to have a total of 10 gigawatts (GW) of net installed renewable energy capacity by the end of 2021, with a target of 100 GW9 by 2030. In comparison, BP has a capacity of 3.3 GW and is aiming for 50 GW10 by 2030. In comparison, US oil companies are investing less in renewable energies, with ExxonMobil focusing on biofuels for the time being11 and carbon capture technologies.

From a Social point of view, regulations in different geographical areas highlight the differences. As a result, issues such as transparency of operations, health and safety standards, and social responsibility towards local communities appear to be more advanced among European companies. The way in which these standards are implemented and followed may differ. European companies have often been at the forefront of the adoption of stricter safety and accident prevention standards. As for US companies, they have also invested in these areas, but may present certain variations depending on the specific regulations in each state. Oil companies may operate in politically unstable geographical areas. This exposes companies to controversy, particularly when it comes to human rights.

Differences within the Governance pillar are smaller. Oil companies have a solid governance system. Controversies tend to focus on corruption, anti-competitive practices and lobbying.

And the winner is ?

The extra-financial rating agencies therefore place European oil stocks above all others. Despite this, major efforts are still required, such as aligning their scope 3 emissions with the Paris Agreement.

To meet the objectives of the Paris Agreement, the transition must be accelerated. As a result, oil stocks are among the most exposed to physical and transitional risks. Asset managers, whether SRI or not, are being called upon, particularly in Europe, to integrate these climate risks into their risk management as part of their fiduciary duty. Another tool used by managers to manage these duties is shareholder engagement.

Commitment

The presence of oil companies in sustainable funds creates a dialogue. The role of shareholders is to push companies to make the transition to meet climate objectives, without neglecting the social aspect.

In 2023, there will be an increase in the number of climate resolution filings known as “climate resolutions”. Say on climate ” at Annual General Meetings, as well as social resolutions. Whether initiated by the company itself or by a coalition of shareholders. Such is the case with Chevron13 whose Annual General Meeting on May 31, 2023 will consider 5 shareholder proposals on environmental issues and one on social issues. At the May 26 meeting, Total Energies also tabled a climate resolution of its own, and an advisory resolution was tabled by the activist shareholder group Follow This. The first was approved by 89%14 while the second, with 30% of the vote, was rejected.

Conclusion

Far from being universally accepted, the transformation of oil stocks plays a key role in the fight against climate change. There are still areas for improvement and opportunities for sustainable funds, such as more green bonds from the oil industry.

Sources

1 BP Statistical Review of World Energy, June 2022

2 Canadian Association of Petrolum Producers (CAPP)

3 The shift project: future oil supplies for the European Union

4 Eurostat data

5 The Guardian (clickable link)

6 International Renewable Energy Agency (IRENA)

7 GOGEL list from Urgewald

8 GOGEL list from Urgewald

9 Total Energies site

10 BP site

11 Moody’s ESG Solution

12 Rating Moody’s / Sustainalytics / MSCI / S&P / Bloomberg

13 ISS

14 La Tribune (clickable link)

Richelieu Gestion | Focus – June 2023

This document is intended exclusively for the person to whom it is given and may not be transmitted or made known to third parties. Past performance is not indicative of future performance and is not constant over time. This document is non-contractual, it is only written for general information, discussion and for information purposes only. This information should not be considered as an offer, an investment research and does not constitute a recommendation to buy or sell any investment or financial product or service. We draw your attention to the necessity and importance of reading the Key Investor Information Document (KIID), a copy of which is available on the website www.richelieugestion.com