Question for the vacations: Inflation target, why 2% and not 3%?

By Alexandre Hezez, Group Strategist

Editorial

Inflation seems to be under control, but we are witnessing a slow, steady deceleration in price rises in the United States. Monetary tightening appears to be coming to an end. The rise in goods prices has been slowing fairly sharply for over a year, starting with raw materials and energy products. Persistent inflation is largely attributable to the service sector, in particular to rising rents. Housing services account for a third of inflation. The correction in the real estate sector should further moderate inflation in the second half of the year. Globally, we’re seeing the same trends, with varying degrees of temporal variation. It seems as if the war waged by central banks against the scourge of inflation is about to be won. The markets are even anticipating rate cuts as early as 2024, as if we were on the verge of returning to the normality we once knew.

However, if we assume that inflation in recent years has remained low thanks to accelerated globalization, cheap raw materials and an absence of major conflicts, the year 2021 has marked a certain reversal of all these factors. The hardest part remains: bringing inflation down from 8% to 9 % to 3 % to 4 %, as base effects are in action. The transition from 1.5 % to 2 % will certainly be trickier.. Clearing these final hurdles is likely to be difficult, and could require a substantial slowdown in activity due to the continued aggressive action of central banks.

A real headache, even though colossal investments are needed to ensure a vital energy transition in parallel with equivalent levels of debt. Calls to halt interest rate hikes by central banks are multiplying.

But what would be the basis for such action, when the inflation target enshrined in central bank mandates is clear: 2 %? In the many debates we’ve had over the last few months, more and more economists, academics and investors are discussing the inflation objective enshrined in central bank mandates. The 2 % dogma seemed to have been established many years ago and is the very foundation of the monetary policy models of all the major central banks.

In the euro zone, for example, the question might seem irrelevant before 2021. Since the 2000s, we have gone from a long period of stable inflation or inflation close to 2 % to a period close to 1 %, with a constant risk of deflation.

Inflation and European Central Bank targets

Sources : Bloomberg, Groupe Richelieu

In an article published in the Nihon Keizai Shinbun, a Japanese business daily, Christine Lagarde insisted that the ECB must “be extremely vigilant in the face of these potential risks… particularly with regard to wage increases in various European countries”. “We have a mandate that assigns us one objective, not two like the Federal Reserve. Our objective is price stability“, she declared, reaffirming that she would focus on controlling inflation.

Central banks remain committed to their primary objective of price stability, which for both the ECB and the Fed is to maintain an inflation rate close to 2 %. In their view, their credibility is at stake.

At the European Central Bank forum in Sintra, the IMF has called on European central banks to “kill the beast” without “pause”. For the IMF Managing Director, the ECB’s monetary tightening policy must continue “until mid-2024, in order to bring inflation back to its target of 2 % somewhere in 2025”.

Tweet from Gita Gopinath , IMF Deputy Managing Director

However, in a recent article, Olivier Blanchard, former IMF chief economist, has suggested raising the central banks’ inflation target from 2 % to 3 % to prevent monetary tightening from causing too much damage to the job market. His arguments, while provocative, make sense, especially given the widely accepted 2 % “dogma”. His objections are not new. Already in 2010, as a senior economist at the IMF, he proposed in a speech to the Club Finance HEC (https://club-finance.hec.fr/) that the inflation benchmark currently at 2 % be raised to 4 %, i.e. that central banks should only start to worry when this new limit is reached.

Does the 2 % target really have a theoretical basis ? Is it possible to modify it? Paul Krugman, winner of the 2008 Nobel Prize, also advocates an inflation target of 3 %. (https://www.gc.cuny.edu/sites/default/files/2022-03/Krugman-Credible-Irresponsibility-Revisited.pdf)

In his view, the changes brought about by the pandemic in the way we work and our purchasing choices have shown that the problems of adjustment are greater than we thought. These would perhaps be more easily resolved if we accepted inflation at 3 % or even 4 %, rather than insisting on bringing it down to 2 %.(https://www.challenges.fr/idees/inflation-non-il-ny-a-pas-de-spirale-prix-salaires_854991)

Jerome Powell, Chairman of the Federal Reserve, spoke out in March against changing the 2 % target, arguing that the central bank’s commitment to this rate was helping to reinforce confidence in price stability, despite current inflationary pressures.

An unnoticed change was made by the ECB in July 2021, but it remains important. Originally, the definition of price stability announced in October 1998 corresponded to “an increase in the harmonized consumer price index for the euro zone of less than 2 %”. In 2021, it was indicated that the objective was now symmetrical, suggesting that the ECB would be just as concerned about inflation that was too low as inflation that was too high.

According to Article 127 of the Treaty on the Functioning of the European Union, the ECB’s primary objective is to maintain price stability. However, the Treaty does not give a precise definition of “price stability”, and it is up to the ECB to determine an operational formulation.

Official Journal of the European Union Article 127

Source : https://eur-lex.europa.eu/

The primary objective of the European System of Central Banks is to maintain price stability. This does not necessarily mean 0 % inflation. Indeed, if price stability was the main objective, why not aim for 0 %?

Over and above all the theoretical aspects and debates between economists, a pedagogical response was given at the Rencontres de la politique monétaire at the Banque de France. Interviewed by influencer Jean Massiet on his Twitch channel, Chairman François Villeroy de Galhau compared inflation to the temperature of the human body: deflation would be like severe anemia, and inflation above 2 % would be comparable to fever. According to Olivier Garnier, General Manager of Banque de France, 2 % is seen by the main central banks as a precautionary margin compared with 0 %.

Linkedin post of Francois Villeroy de Galhau

Source : https://lnkd.in/e3SYV62i

In his opinion, there is inherent uncertainty in measuring inflation. For example, it is difficult to take into account improvements in the quality of goods and services in consumer price indices. Actual inflation could therefore be slightly lower than measured inflation. By targeting 2 %, central banks ensure that they have a safety margin against deflation, even if actual inflation is slightly lower than measured inflation.

Secondly, slightly positive inflation can help facilitate economic adjustments. For example, it can be difficult for employers to reduce nominal wages, even when economic conditions justify it. Slightly positive inflation means that real wages can be reduced without affecting nominal wages.

What’s more, if inflation is too low, nominal interest rates are also likely to be very low, limiting the scope for central banks to cut rates in the event of an economic slowdown.

Finally, it is important to note that the 2% target has been widely adopted by central banks around the world, reinforcing its credibility. Changing this objective could cast doubt on central banks’ commitment to maintaining price stability, which in turn could undermine their credibility and ability to influence inflation expectations.

However, some economists, such as Olivier Blanchard and Paul Krugman, have suggested that central banks might consider raising their inflation targets. The debate over the appropriate inflation target is a complex one, involving trade-offs between different economic policy objectives.

So there are two opposing schools of thought, with arguments of varying origins. For Blanchard and Krugman, what matters above all is the suffering on the job market(https://www.lesechos.fr/monde/enjeux-internationaux/inflation-le-plaidoyer-de-leconomiste-olivier-blanchard-pour-relever-lobjectif-a-3-1958170), while on the other hand it’s the promise of price stability to ensure sustainable growth.

From the central banks’ point of view, the “famous 2 %” is simply a way of achieving price stability (i.e. close to 0 %!) without risking deflation.

It is also important to note that monetary policy cannot solve all economic problems. Governments must also implement appropriate fiscal and structural policies to stimulate economic growth and stability.

The inflation target debate reflects the complex and interconnected challenges facing modern economies. Ultimately, the 2 % inflation target is based on a judgment of balance between the risks of deflation, the constraints of lower interest rates and the credibility of central banks. If economic conditions change significantly, it would be possible to revise this target, but this would require a careful assessment of the potential benefits and drawbacks. We are convinced that it will be impossible to get out of the dogma, at least as long as the risks of structural inflation remain entrenched.

There is no single solution to these challenges and the best way forward will depend on the specific circumstances of each economy. Decisions taken today will have repercussions on tomorrow’s economy, which is why it’s crucial to maintain an open and informed debate on these issues..

CONVICTIONS

Disinflation scheduled for a few months but ….

The pattern emerging over the next few months seems fairly clear at the macroeconomic level. There are, of course, areas of doubt and uncertainty that we’ll be keeping a close eye on, notably the Chinese economic rebound, the geopolitical situation and, of course, inflation. But right now, the latest two-day meeting of the annual European Monetary Policy Forum in Sintra showed that the current issue is not growth, but the fight against inflation, which could prove persistent.

The market remains complacent that central banks will begin a cycle of rate cuts next year. We don’t think we can expect any such moments in 2024, at least from the Fed, ECB and BOE, even if the disinflation trend asserts itself in the coming months. There is also the fear of losing credibility after the delay in 2021 and the belied confidence in a rapid decline in inflation. Indeed, the Fed, and above all the ECB, waited too long to start tightening in March 2022 and July 2022 respectively, when inflation had already reached historic highs (8.5% in the US, 7.4% in the Eurozone).

It’s also the fear of entering into a stop-and-go spiral of the 70s, which was a failure before Paul Volcker arrived. The conclusion of these two experiments is obvious: central banks need to raise their interest rates to a fairly restrictive level, and at the same time to a level that does not oblige them to lower them in the event of a crisis.

Inflation in the 1970s

Sources : Bloomberg, Groupe Richelieu

The episode involving the regional banks and the collapse of the SVB and some of its sister banks proved to be a good test. The Fed can act quickly and decisively, but does not change its strategy. So we’ll have to wait a while before we can be sure that inflation is under control, or even until deflation risks return to the fore! (We’ll see in 2025 ( J ). Generally speaking, the easiest job is being done… bringing inflation down from 8% to 9% to 3% to 4%, as base effects are in action. The transition from 3% to 4% to 1.5% to 2% will certainly be trickier.

Inflation 2018-2023

Sources: Bloomberg, Richelieu Group

As we enter the 2nd half of the year, there is now a lag between inflation, growth and monetary policy, which determines our asset allocations.

In the United States, the balance of the moment

Inflation : disinflation is underway.

In the United States, disinflation is underway and should accelerate over the next few months to the level of Core inflation (excluding energy and raw materials), given the impact of rising interest rates on rents, which is just beginning to take effect.

The road to inflation returning to target is therefore well and truly underway. In terms of monetary policy, the job is practically done. Even if Jerome Powell maintains his aggressive rhetoric to prevent the markets from “gambling” the end of aggressive normalization, he will a priori only need one more hike after the one in July. Rates are likely to remain high over the next few months, and the curve should gradually flatten as a permanently restrictive policy (higher long-term rates) is taken into account. Inflation expectations remain anchored, which is good news.

Anticipated inflation 5 years from now 5 years from now

Sources: Bloomberg, Richelieu Group

Economic growth : surprising resilience

Consumer confidence is set to pick up as inflationary momentum fades. US growth was surprisingly resilient in the first half of 2023, underpinned by still buoyant household demand, particularly in services, where Americans’ spending has returned to pre-pandemic levels. Our growth forecast for this year is +1.3%. The industry has been weakened by the decline in order books due to the slowdown in domestic and global demand, as well as high business costs. The Fed will do its utmost to avoid a strong economic recovery that could prove inflationary. The real estate sector will have less of a negative impact on growth than in recent quarters (the most recent data point to the start of a rebound in activity). Despite historically high mortgage rates, a downturn in construction activity is taking place in the face of a shortage of housing supply, cost-cutting and supply difficulties, as well as the return of foreign labor.

Unemployment and participation rates in the United States

Sources: Bloomberg, Richelieu Group

Impact on markets: confidence in the Fed and the economy

We remain constructive on US assets, as we believe that the Fed is, for the time being, the most visible and credible central bank in its fight against inflation, without creating a recession in 2023. The dollar’s decline should boost exports. We expect a tactical rebound in small and mid-caps, given investors’ bearish stance (holding levels remain low), valuations, technical indicators and macroeconomic factors. As a general rule, we will avoid companies with too high a debt ratio.

Small caps in portfolios

Source : Bofa

Large technology companies have benefited greatly from AI and its as yet untapped prospects. Interest rates should continue to rise. Bond segments continue to deliver appreciable returns despite bankruptcy increases. We favor quality assets in all segments. Even if some tensions may arise, US Investment Grade bonds appear to be the best diversification against the risk of recession (which is not our scenario) in a diversified portfolio.

In Europe : clouds notwithstanding

Inflation : still a long way to go

Many ECB members are pointing to the risks of inflation expectations going off track and the uncertainties surrounding price trends. Although the end of fiscal support may help the ECB to reduce inflation, energy prices remain a risk dependent on weather conditions and supply channels, which could generate further tensions in the months ahead.

Small caps in portfolios

Sources : Bloomberg, Groupe Richelieu

Monetary policy : credibility with regard to inflation first and foremost

The European Central Bank does not yet see sufficient evidence that core inflation is on a downward trajectory. A significant decline in core inflation is required before rates can be considered to stop rising. Isabel Schnabel was clear that it was preferable to take the risk of “doing too much rather than too little”.

Although divergence persists within the eurozone, with industry in contraction, the latter are slowing down, which is good news for the ECB in its fight against inflation. Indeed, a slowdown in activity in the services sector is still necessary to reduce the underlying inflation rate, which is still too high today. Monetary policy will have to be kept permanently in restrictive territory, and the ECB will be able to count on the gradual withdrawal of public spending. We expect at least 2 further rate hikes.

Key ECB interest rates

Sources: Bloomberg, Richelieu Group

Economic growth : dynamism at half-mast

Eurozone PMI activity indices showed a significant slowdown in economic activity, prompting a sharp resurgence of recessionary fears. The situation in Germany seems a notch more reassuring, but services are also penalized there, a sign that household demand remains poorly oriented in the very present inflationary context on the other side of the Rhine. While the end of fiscal support may help the ECB in its fight against inflation, energy prices remain a risk that depends on weather conditions and supply channels, and could generate new tensions in the months ahead.

Eurozone PMI

Sources: Bloomberg, Richelieu Group

Impact on markets: Central banks must exert pressure

The economic downturn combined with the most restrictive central banks is leading us to be cautious on European equities. The UK remains particularly under pressure. Certain sectors should be favored, given their catch-up effects, such as banking (fundamentals remain good and the risk premium remains high) or visible-growth sectors that have suffered from the speed of rising interest rates (utilities, healthcare). The luxury goods sector, in which we had a strong conviction, should suffer from its short-term success and underperform in the coming months, without jeopardizing its long-term growth. We are also taking a more defensive stance in our sector positioning, favoring non-cyclical sectors.

In bonds, we prefer shorter maturities and the most balanced segments in terms of risk/return (BBB/BB). We believe there could be some rate pressure to exploit during the quarter. The market seems to be taking a breather, justified by the tightening of spreads in recent weeks, which followed a lull in the banking sector and a very active primary market, particularly for financials. In the short term, we are more cautious despite the posted rates of return. We have reduced our risk and are now neutral on Investment Grade after the good performance of recent weeks. We don’t want to deprive ourselves of carry and are positioning ourselves on instruments that offer a good return but lower risk, such as certain corporate hybrids.

Europe crossover credit spreads (BBB/BB rating)

Sources: Bloomberg, Richelieu Group

In Japan : an infatuation that may be a little excessive

Inflation : BoJ still doesn’t believe in inflation

The release of CPI inflation data confirms that inflationary pressures are increasingly sustainable, reaching a 42-year high. Core inflation accelerated in June, remaining above the central bank’s 2% target for the 13th consecutive month, a sign that price rises are spreading to other sectors of the economy. Inflationary pressure remains strong, as there are few signs that companies have finished raising prices. A survey of food producers showed that they plan to increase prices for many items this year. Strong domestic demand and changes in corporate pricing behavior are further factors driving inflation upwards.

In terms of monetary policy : the historical prism of deflation should disappear

Markets are focusing on new quarterly growth and inflation projections from the Bank of Japan (BOJ), expected at the next rate review on July 27 and 28, for clues as to when the central bank might end its stimulus measures. BOJ Governor Kazuo Ueda has repeatedly stated that the BOJ will maintain an ultra-flexible policy until stronger wage growth keeps inflation permanently around its 2% target. For the time being, the BOJ remains on the assumption that inflation will come down at some point, given the outlook for the global economy. However, we believe it will have to do so in the 3rd quarter. This will have an impact on global interest rates, given Japan’s large positions in foreign government bonds. With this in mind, we are maintaining a negative bias on government yields.

Economic growth : catching up in progress

Japanese business confidence has improved across the board, confirming our view that the country’s economy is gradually recovering. First-quarter GDP was revised upwards thanks to higher-than-expected investment by private companies, which seem to have benefited from the improved situation in supply chains. In particular, growth in non-residential investment by private companies was much higher. The Japanese economy is still in catch-up mode.

Consumer confidence in Japan

Sources: Bloomberg, Richelieu Group

Market impact: Japan’s negative real interest rates are unlikely to last

With Japanese real interest rates still negative due to the BOJ’s ultra-accommodating policy, this continues to favor risky assets in the short term. However, this should not last. Our position on Japanese equities remains neutral, given the approaching end of this policy, which should lead to a positive turnaround in the currency. We prefer Japanese equities without currency hedging. The yen’s rise could have a very negative impact on exporting companies in the second half of the year. We prefer innovative growth companies and cyclical stocks, which should benefit from the economy’s resilience.

Yen & intervention

Source : Financial Times

In China, all economic indicators reinforce the need to support activity

Inflation : no brake on accommodating policy

China continues to stand out from developed countries where prices have risen steadily, particularly in the food sector. Unlike the rest of the world, China has no inflation. Pending a clearer recovery in industrial activity, its weakness is helping to curb global inflation. Conversely, a stronger recovery at the end of the year could drive prices upwards, putting the ECB in an uncomfortable position.

Inflation and producer prices in China

Sources : Bloomberg, Groupe Richelieu

Monetary policy : waiting for the pause Fed

Monetary support should also be stepped up as China’s central bank reiterated its intention to increase its support for activity, while taking care to limit its impact on the foreign exchange market and real estate. Indeed, recent Chinese stimulus packages have been marked by speculative bubbles that have proved harmful. On the other hand, the PBoC’s survey of banks shows a clear drop in loan demand from businesses, which calls for targeted action. This should favor a continuation of the Chinese economic rebound in the second half of the year, limiting the risk of a significant downturn in global growth. We believe that the end of rate hikes by the Fed should allow for more consistent action. For the time being, the PBOC is limited by the impact on its currency against a dollar strengthened by successive rate hikes. The yuan continues to depreciate, prompting the People’s Bank of China to step up its support for the currency. This situation is unfavorable in the short term, but should be reversed given our scenario (end of the Fed’s aggressive monetary policy). China’s central bank is likely to be one of the most accommodating, cutting rates to support consumption and investment.

Rates of the main emerging central banks

Sources : Bloomberg, Groupe Richelieu

Economic growth : disappointing so far

There has been no rebound yet in China, where industrial production is stagnating and not benefiting from the end of epidemic-related restrictions. China’s Caixin manufacturing PMI remains resilient. For the Chinese authorities, greater support is necessary, and the central bank has opened the way to its reinforcement, while reiterating that it wishes to avoid excessive movements on the foreign exchange market. The contraction in imports is partly due to the slowdown in global demand, which in turn affects Chinese imports of parts and components. China’s logistics sector grew at a faster pace in June, indicating that we should see better prospects in the months ahead. Household consumption should remain the main driver of growth. After Antony Blinken, the head of US diplomacy, Janet Yellen’s trip to China to meet Chinese officials demonstrates the efforts and importance of a growing Chinese economy for the United States, despite geopolitical tensions and national security issues. In less than two months, this change of tone has been a positive catalyst.

Source : twitter

Impact on markets: a better outlook for the second half of the year

Emerging markets, particularly China, have underperformed since the start of the year, despite an encouraging inflation outlook and economic recovery. Chinese equities have been hit by a triple whammy since peaking in 2021. The government launched a regulatory overkill on businesses, the rigid zero Covid policy crushed demand and the real estate sector collapsed. The gradual reopening of the economy, notably following a protest movement, has yet to bear fruit. At the beginning of the year, we thought that the reopening would materialize in the second half of the year, and that the markets would anticipate this. If doubt persists, our scenario has not changed. After a sluggish start to the year, foreign investment flows into emerging market equities surged in May. Lipper data show $2 billion in capital inflows between May 3 and May 24, which is a good sign. Equity fund flows to India are particularly noteworthy, having reached a nine-month high during the month. The improvement in sentiment towards emerging markets can be explained by the valuation gap with developed market equities, as well as diverging growth forecasts for the second half of 2023. Emerging market bonds should also benefit from a less tense Fed and their own monetary policy, which began long before that of developed banks. If China’s growth scenario takes hold, commodities should begin to rebound in the third quarter.

Emerging equity markets versus the rest of the world

Sources: Bloomberg, Richelieu Group

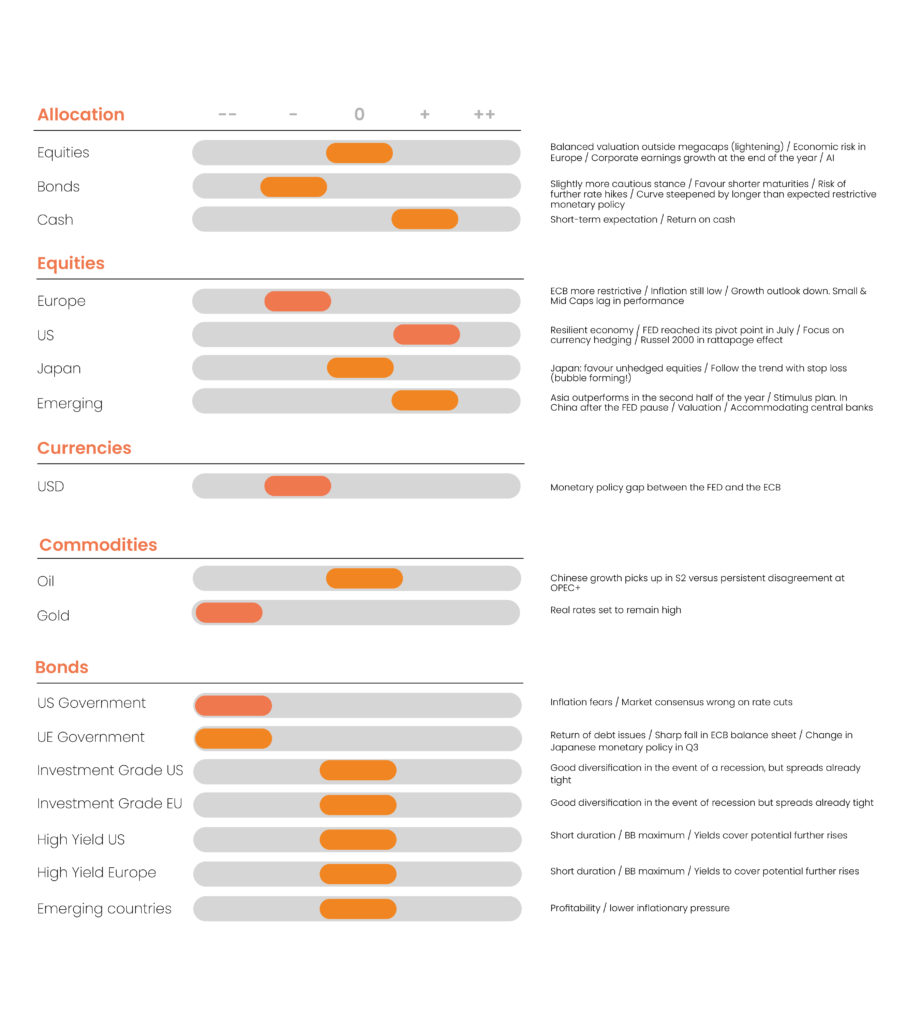

SUMMARY:

In the short term, we are tactically lowering our view on bonds in favor of cash, which seems to us to offer good returns and will enable us to wait for the next central bank deadlines.

We remain invested in equities, focusing mainly on the United States (for its macro and monetary visibility) and emerging countries such as China (for its more accommodating monetary policies and accelerating growth prospects in the second half of the year).

With real interest rates set to remain at high levels and the outlook for inflation falling this year, we are negative on gold.

The dollar is likely to remain under pressure as the Fed and the ECB continue to differ in their attitudes.

Oil is set to rebound as the market pushes back the recession outlook to 2023.

CONCLUSION IN TERMS OF ASSET ALLOCATION

Synthesis Strategy Richelieu Group – Author

Alexandre HEZEZ

Group Strategist

Disclaimer

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

The information, opinions and estimates contained in this document are for information purposes only. No element can be considered as an investment advice or a recommendation, a canvassing, a solicitation, an invitation or an offer to sell or to subscribe to the securities or financial instruments mentioned. The information provided concerning the performance of a security or financial instrument always refers to the past. Past performance of securities or financial instruments is not a reliable indicator of future performance.

All potential investors should conduct their own analysis of the legal, tax, accounting and regulatory aspects of each transaction, if necessary with the advice of their usual advisors, in order to be able to determine the benefits and risks of the transaction and its appropriateness to their particular financial situation. He does not rely on Richelieu Gestion for this.

Finally, the content of the research or analysis documents or their excerpts, if any, attached or quoted, may have been altered, modified or summarized. This document has not been prepared in accordance with the regulatory provisions designed to promote the independence of financial analysis. Richelieu Gestion is not prohibited from trading in the securities or financial instruments mentioned in this document prior to its publication.

Market data is from Bloomberg sources.